2010 European sovereign debt crisis

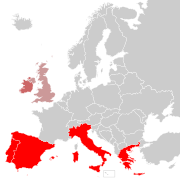

In early 2010, fears of a sovereign debt crisis, the 2010 Euro Crisis[1] (also known as the Aegean Contagion),[2] developed concerning some European nations,[3] including European Union members Greece, Spain,[4] and Portugal.[5] This led to a crisis of confidence as well as the widening of bond yield spreads and risk insurance on credit default swaps between these countries and other EU members, most importantly Germany.[6][7]

Concern about rising government deficits and debt levels[8][9] across the globe together with a wave of downgrading of European government debt[10] has created alarm in financial markets. The debt crisis has been mostly centred on recent events in Greece, where there is concern about the rising cost of financing government debt. On 2 May 2010, the Eurozone countries and the International Monetary Fund agreed to a €110 billion loan for Greece, conditional on the implementation of harsh Greek austerity measures.[11] On 9 May 2010, Europe's Finance Ministers approved a comprehensive rescue package worth almost a trillion dollars aimed at ensuring financial stability across Europe by creating the European Financial Stability Facility.[12]

Contents |

Greek government funding crisis

Causes

The Greek economy was one of the fastest growing in the eurozone during the 2000s; from 2000 to 2007 it grew at an annual rate of 4.2% as foreign capital flooded the country.[13] A strong economy and falling bond yields allowed the government of Greece to run large structural deficits. According to an editorial published by the Greek newspaper Kathimerini, large public deficits are one of the features that have marked the Greek social model since the restoration of democracy in 1974. After the removal of the right leaning military junta, the government wanted to bring disenfrachised left leaning portions of the population into the economic mainstream.[14] In order to do so, successive Greek governments have, among other things, run large deficits to finance public sector jobs, pensions, and other social benefits.[15] Since 1993 debt to GDP has remained above 100%.[16]

Initially currency devaluation helped finance the borrowing. After the introduction of the euro Greece was initially able to borrow due the lower interest rates government bonds could command. The global financial crisis that began in 2008 had a particularly large effect on Greece. Two of the country's largest industries are tourism and shipping, and both were badly affected by the downturn with revenues falling 15% in 2009.[16]

To keep within the monetary union guidelines, the government of Greece has been found to have consistently and deliberately misreported the country's official economic statistics.[17][18] In the beginning of 2010, it was discovered that Greece had paid Goldman Sachs and other banks hundreds of millions of dollars in fees since 2001 for arranging transactions that hid the actual level of borrowing.[19] The purpose of these deals made by several subsequent Greek governments was to enable them to spend beyond their means, while hiding the actual deficit from the EU overseers.[20] Although similar irregularities and "massaging" of statistics to cope with monetary union guidelines have also been observed in cases of other EU countries ,[21][22] Greece was seen as the worst case.

In 2009, the government of George Papandreou revised its deficit from an estimated 6% (8% if a special tax for building irregularities were not to be applied) to 12.7%.[23] In May 2010, the Greek government deficit was estimated to be 13.6%[24] which is one of the highest in the world relative to GDP.[25] Greek government debt was estimated at €216 billion in January 2010.[26] Accumulated government debt is forecast, according to some estimates, to hit 120% of GDP in 2010.[27] The Greek government bond market is reliant on foreign investors, with some estimates suggesting that up to 70% of Greek government bonds are held externally.[28]

Estimated tax evasion costs the Greek government over $20 billion per year.[29] Despite the crisis, Greek government bond auctions have all been over-subscribed in 2010 (as of 26 January).[30] According to the Financial Times on 25 January 2010, "Investors placed about €20bn ($28bn, £17bn) in orders for the five-year, fixed-rate bond, four times more than the (Greek) government had reckoned on." In March, again according to the Financial Times, "Athens sold €5bn (£4.5bn) in 10-year bonds and received orders for three times that amount."[31]

Downgrading of debt

On 27 April 2010, the Greek debt rating was decreased to the first levels of 'junk' status by Standard & Poor's amidst fears of default by the Greek government.[32] Yields on Greek government two-year bonds rose to 15.3% following the downgrading.[33] Some analysts question Greece's ability to refinance its debt. Standard & Poor's estimates that in the event of default investors would lose 30–50% of their money.[32] Stock markets worldwide declined in response to this announcement.[34]

Following downgradings by Fitch, Moody's and S&P,[35] Greek bond yields rose in 2010, both in absolute terms and relative to German government bonds.[36] Yields have risen, particularly in the wake of successive ratings downgrading. According to the Wall Street Journal "with only a handful of bonds changing hands, the meaning of the bond move isn't so clear."[37] As of 6 May 2010, Greek 10-year bonds were trading at an effective yield of 11.31%.[38]

On 3 May 2010, the European Central Bank suspended its minimum threshold for Greek debt "until further notice",[39] meaning the bonds will remain eligible as collateral even with junk status. The decision will guarantee Greek banks' access to cheap central bank funding, and analysts said it should also help increase Greek bonds' attractiveness to investors.[40] Following the introduction of these measures the yield on Greek 10-year bonds fell to 8.5%, 550 basis points above German yields, down from 800 basis points earlier.[41]

Austerity and loan agreement

On 5 March 2010, the Greek parliament passed the Economy Protection Bill, expected to save €4.8 billion[42] through a number of measures including public sector wage reductions. On 23 April 2010, the Greek government requested that the EU/IMF bailout package be activated.[43] The IMF had said it was "prepared to move expeditiously on this request".[44] Greece needed money before 19 May, or it would face a debt roll over of $11.3bn.[45][46][47]

On 2 May 2010, a loan agreement was reached between Greece, the other Eurozone countries, and the International Monetary Fund. The deal consisted of an immediate €45 billion in loans to be provided in 2010, with more funds available later. A total of €110 billion has been agreed.[48][49] The interest for the Eurozone loans is 5%, considered to be a rather high level for any bailout loan. The government of Greece agreed to impose a fourth and final round of austerity measures. These include:[50]

- Public sector limit of €1,000 introduced to bi-annual bonus, abolished entirely for those earning over €3,000 a month.

- An 8% cut on public sector allowances and a 3% pay cut for DEKO (public sector utilities) employees.

- Limit of €800 per month to 13th and 14th month pension installments; abolished for pensioners receiving over €2,500 a month.

- Return of a special tax on high pensions.

- Changes were planned to the laws governing lay-offs and overtime pay.

- Extraordinary taxes imposed on company profits.

- Increases in VAT to 23%, 11% and 5.5%.

- 10% rise in luxury taxes and taxes on alcohol, cigarettes, and fuel.

- Equalization of men's and women's pension age limits.

- General pension age has not changed, but a mechanism has been introduced to scale them to life expectancy changes.

- A financial stability fund has been created.

- Average retirement age for public sector workers has increased from 61 to 65.[51]

- Public-owned companies to be reduced from 6,000 to 2,000.[51]

On 5 May 2010, a nationwide general strike was held in Athens to protest to the planned spending cuts and tax increases. Three people were killed, dozens injured, and 107 arrested.[52]

According to research published on 5 May 2010, by Citibank, the EMU loans will be pari passu and not senior like those of the IMF. In fact the seniority of the IMF loans themselves has no legal basis but is respected nonetheless. The amount of the loans will cover Greece's funding needs for the next three years (estimated at 30bn for the rest of 2010 and 40bn each for 2011 and 2012). Citibank finds the fiscal tightening "unexpectedly tough". It will amount to a total of €30 billion (i.e. 12.5% of 2009 Greek GDP) and consist of 5% of GDP tightening in 2010 and a further 4% tightening in 2011.[53]

Danger of default

Without a bailout agreement, there was a possibility that Greece would have been forced to default on some of its debt. The premiums on Greek debt had risen to a level that reflected a high chance of a default or restructuring. Analysts gave a 25% to 90% chance of a default or restructuring.[54][55] A default would most likely have taken the form of a restructuring where Greece would pay creditors only a portion of what they were owed, perhaps 50 or 25 percent.[56] This would effectively remove Greece from the euro, as it would no longer have collateral with the European Central Bank. It would also destabilise the Euro Interbank Offered Rate, which is backed by government securities.[57]

Because Greece is a member of the eurozone, it cannot unilaterally stimulate its economy with monetary policy. For example, the U.S. Federal Reserve expanded its balance sheet by over $1.3 trillion USD since the global financial crisis began, essentially printing new money and injecting it into the system by purchasing outstanding debt.[58]

The overall effect of a probable Greek default would itself be small for the other European economies. Greece represents only 2,5% of the eurozone economy.[59] The more severe danger is that a default by Greece will cause investors to lose faith in other Eurozone countries. This concern is focused on Portugal and Ireland, all of whom have high debt and deficit issues.[60] Italy also has a high debt, but its budget position is better than the European average, and it is not considered amongst the countries most at risk.[61] Recent rumours raised by speculators about a Spanish bail-out were dismissed by Spanish President Mr. Zapatero as "complete insanity" and "intolerable".[62] Spain has a comparatively low debt amongst advanced economies, at only 53% of GDP in 2010, more than 20 points less than Germany, France or the US, and more than 60 points less than Italy, Ireland or Greece,[63] and it doesn't face a risk of default.[64] Spain and Italy are far larger and more central economies than Greece, both countries have most of their debt controlled internally, and are in a better fiscal situation than Greece and Portugal, making a default unlikely unless the situation gets far more severe.[65]

Objections to proposed policies

- See also May 2010 Greek protests

The crisis is seen as a justification for imposing fiscal austerity[66] on Greece in exchange for European funding which would lower borrowing costs for the Greek government.[67] The negative impact of tighter fiscal policy could offset the positive impact of lower borrowing costs and social disruption could have a significantly negative impact on investment and growth in the longer term. Joseph Stiglitz has also criticised the EU for being too slow to help Greece, insufficiently supportive of the new government, lacking the will power to set up sufficient "solidarity and stabilisation framework" to support countries experiencing economic difficulty, and too deferential to bond rating agencies.[68]

An alternative to the bailout agreement, would have been Greece leaving the Eurozone. Wilhelm Hankel, professor emeritus of economics at the University of Frankfurt am Main suggested[69] in an article published in the Financial Times that the preferred solution to the Greek bond 'crisis' is a Greek exit from the euro followed by a devaluation of the currency. Fiscal austerity or a euro exit is the alternative to accepting differentiated government bond yields within the Euro Area. If Greece remains in the euro while accepting higher bond yields, reflecting its high government deficit, then high interest rates would dampen demand, raise savings and slow the economy. An improved trade performance and less reliance on foreign capital would result.

Possible spread beyond Greece

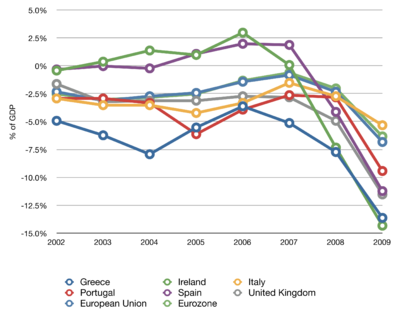

One of the central concerns prior to the bailout was that the crisis could spread beyond Greece. The crisis has reduced confidence in other European economies. Ireland, with a government deficit of 14.3 percent of GDP, the U.K. with 12.6 percent, Spain with 11.2 percent, and Portugal at 9.4 percent are most at risk.[70][71][72]

In April 2010, following a marked increase in Irish 2-year bond yields, Ireland's NTMA state debt agency said that it had "no major refinancing obligations" in 2010. Its requirement for €20 billion in 2010 was matched by a €23 billion cash balance, and it remarked: "We're very comfortably circumstanced".[73] On 18 May the NTMA tested the market and sold a €1.5 billion issue that was three times oversubscribed.[74]

According to the Financial Times: "So far, investors have concentrated their ire on peripheral eurozone economies because of the zone's inability to resolve cleanly the Greek crisis. That is understandable, say many economists, but they add that the focus on continental Europe is unfair."[75] According to the European Commission, the U.K. budget deficit will surpass Greece's as worst in EU this calendar year.[76]

Shortly after the announcement of the EU's new "emergency fund" for eurozone countries in early May 2010, Spain's government announced new austerity measures designed to further reduce the country's budget deficit.[77] The socialist government had hoped to avoid such deep cuts, but weak economic growth as well as domestic and international pressure forced the government to expand on cuts already announced in January. As one of the largest eurozone economies the condition of Spain's economy is of particular concern to international observers, and faced pressure from the United States, the IMF, other European countries and the European Commission to cut its deficit more aggressively.[78][79]

Niall Ferguson writes that "the sovereign debt crisis that is unfolding ... is a fiscal crisis of the western world".[80] Financing needs for the Eurozone in 2010 come to a total of €1.6 trillion, while the US is expected to issue US$1.7 trillion more Treasury securities in this period,[81] and Japan has ¥213 trillion of government bonds to roll over.[82] The countries most at risk are those that rely on foreign investors to fund their government sector. According to Ferguson similarities between the U.S. and Greece should not be dismissed.[83]

For 2010, the OECD forecasts $16,000bn will be raised in government bonds among its 30 member countries. Greece has been the notable example of an industrialised country that has faced difficulties in the markets because of rising debt levels. Even countries such as the US, Germany and the UK, have had fraught moments as investors shunned bond auctions due to concerns about public finances and the economy.[84] According to Niall Ferguson in the Financial Times: "Only two things have thus far stood between the US and higher bond yields: purchases of Treasuries by the Federal Reserve and reserve accumulation by the Chinese monetary authorities. But now the Fed is phasing out such purchases and is expected to wind up quantitative easing. Meanwhile, the Chinese have sharply reduced their purchases of Treasuries from around 47 per cent of new issuance in 2006 to 20 per cent in 2008 to an estimated 5 per cent last year."[85]

On the positive side, The Economist acknowledged on 27 May 2010 that while Europe's "profligate economies will struggle ... as austerity kicks in," it also pointed out that "waning confidence will be mitigated by the boost that exports receive from the euro’s plunge."[86]

Long-term solutions

European Union leaders have made two major proposals for ensuring fiscal stability in the long term. The first proposal is the creation of the European Financial Stability Facility.[87] The second is a single authority responsible for tax policy oversight and government spending coordination of EU member countries, temporarily called the European Treasury.[88] The stability facility is financially backed by the EU and the IMF. The European Parliament, the European Council, and especially the European Commission, can all provide some support for the treasury while it is still being built. However, strong European Commission oversight in the fields of taxation and budgetary policy and the enforcement mechanisms that go with it have been described as infringements on the sovereignty of eurozone member states[89] and are opposed by key EU nations such as France and Italy, which could jeopardise the establishment of a European Treasury.

Some think-tanks such as the CEE Council have argued that the predicament some EU countries find themselves in is the result of a decade of debt-fueled macroeconomic policies pursued by local policy makers and complacent EU central bankers,[90] and have recommended the imposition of a battery of corrective policies to control public debt. Some senior German policy makers went as far as to say that emergency bailouts should bring harsh penalties to EU aid recipients such as Greece.[91] Others argue that an abrupt return to "non-Keynesian" financial policies is not a viable solution and predict the deflationary policies now being imposed on countries such as Greece and Spain might prolong and deepen their recessions.[92] The Economist has suggested that ultimately the Greek "social contract," which involves "buying" social peace through public sector jobs, pensions, and other social benefits, will have to be changed to one predicated more on price stability and government restraint if the euro is to survive.[93] As Greece can no longer devalue its way out of economic difficulties it will have to more tightly control spending than it has since the inception of the Third Hellenic Republic.

Regardless of the corrective measures chosen to solve the current predicament, as long as cross border capital flows remain unregulated in the Euro Area,[94] asset bubbles[95] and current account imbalances are likely to continue. For example, a country that runs a large current account or trade deficit (i.e., it imports more than it exports) must also be a net importer of capital; this is a mathematical identity called the balance of payments. In other words, a country that imports more than it exports must also borrow to pay for those imports. Conversely, Germany's large trade surplus (net export position) means that it must also be a net exporter of capital, lending money to other countries to allow them to buy German goods.[96] The 2009 trade deficits for Spain, Greece, and Portugal were estimated to be $69.5 billion, $34.4B and $18.6B, respectively ($122.5B total), while Germany's trade surplus was $109.7B.[97] A similar imbalance exists in the U.S., which runs a large trade deficit (net import position) and therefore is a net borrower of capital from abroad. Ben Bernanke warned of the risks of such imbalances in 2005, arguing that a "savings glut" in one country with a trade surplus can drive capital into other countries with trade deficits, artificially lowering interest rates and creating asset bubbles.[98][99]

A country with a large trade surplus would generally see the value of its currency appreciate relative to other currencies, which would reduce the imbalance as the relative price of its exports increases. This currency appreciation occurs as the importing country sells its currency to buy the exporting country's currency used to purchase the goods. However, many of the countries involved in the crisis are on the Euro, so this is not an available solution at present. Alternatively, trade imbalances might be addressed by changing consumption and savings habits. For example, if a country's citizens saved more instead of consuming imports, this would reduce its trade deficit. Likewise, reducing budget deficits is another method of raising a country's level of saving. Capital controls that restrict or penalize the flow of capital across borders is another method that can reduce trade imbalances. Interest rates can also be raised to encourage domestic saving, although this benefit is offset by slowing down an economy and increasing government interest payments.[100]

The suggestion has been made that long term stability in the eurozone requires a common fiscal policy rather than controls on portfolio investment.[101] In exchange for cheaper funding from the EU, Greece and other countries, in addition to having already lost control over monetary policy and foreign exchange policy since the euro came into being, would therefore also lose control over domestic fiscal policy.

Controversies

Credit rating agencies

The international credit rating agencies – Moody's, S&P and Fitch – have played a central[102] and controversial role[103] in the current European bond market crisis.[104] As with the housing bubble[105][106] and the Icelandic crisis,[107][108] the ratings agencies have been under fire. The agencies have been accused of giving overly generous ratings due to conflicts of interest.[109] Ratings agencies also have a tendency to act conservatively, and to take some time to adjust when a firm or country is in trouble.[110] In the case of Greece, the market responded to the crisis before the downgrades, with Greek bonds trading at junk levels several weeks before the ratings agencies began to describe them as such.[102]

Government officials have criticised the ratings agencies and the German finance minister has said traders should not take global rating agencies "too seriously" following downgrades of Greece, Spain and Portugal. Guido Westerwelle, German foreign minister, called for an "independent" European rating agency, which could avoid the conflicts of interest that he claimed US-based agencies faced.[111] According to the Financial Times "The latest furore over the agencies' role in the sovereign debt market"[111] is likely to bring about more supervision of these agencies. Germany's foreign minister suggested the European Union should create its own rating agency. He spoke after downgrades of Greece and Portugal roiled financial markets.[102]

European leaders are reportedly studying the possibility of setting up a European ratings agency in order that the private U.S.-based ratings agencies have less influence on developments in European financial markets in the future.[112][113] Due to the failures of the ratings agencies, European regulators will be given new powers to supervise ratings agencies.[103] These supervisory powers will come into effect in December 2010.

In a response to the actions of the private U.S. based ratings agencies the ECB announced on 3 May that it will accept as collateral all outstanding and new debt instruments issued or guaranteed by the Greek government, regardless of the nation's credit rating.[114]

Media

There has been considerable controversy about the role of the English-language press in the regard to the bond market crisis.[115][116] Spanish Prime Minister José Luis Rodríguez Zapatero ordered the Centro Nacional de Inteligencia intelligence service to investigate the role of the "Anglo-Saxon media" in fomenting the crisis.[117][118][119][120] No results have so far been reported as a result of this investigation.

According to the Madrid daily El País, "the National Intelligence Center (CNI) was investigating 'whether investors' attacks and the aggressiveness of some Anglo-Saxon [sic] media are driven by market forces and challenges facing the Spanish economy, or whether there is something more behind this campaign.'"[121][122][123] The Spanish Prime Minister has suggested[124] that the recent financial market crisis in Europe is an attempt to draw international capital away from the euro[125] in order that countries, such as the U.K. and the U.S., can continue to fund their large external deficits which are matched by large government deficits.[8] The U.S. and U.K. do not have large domestic savings pools to draw on and therefore are dependent on external savings.[126] This is not the case in the Eurozone which is self funding.[127]

Greek Prime Minister Papandreou is quoted as saying that there was no question of Greece leaving the euro and suggested that the crisis was politically as well as financially motivated. "This is an attack on the eurozone by certain other interests, political or financial".[128] On the same time, a statistic on the articles referenced here shows that only "bad" news were propagated by the media and never "good" news.

Role of speculators

Financial speculators and hedge funds engaged in selling euros have also been accused by both the Spanish and Greek Prime Ministers of worsening the crisis.[129][130] Angela Merkel has stated that "institutions bailed out with public funds are exploiting the budget crisis in Greece and elsewhere."[131]

The role of Goldman Sachs[132] in Greek bond yield increases is also under scrutiny.[133] It is not yet clear to what extent this bank has been involved in the unfolding of the crisis or if they have made a profit as a result of the sell-off on the Greek government debt market.

In response to accusations that speculators were worsening the problem, some markets banned naked short selling for a few months.[134]

Timeline of Greek crisis

Below is a brief summary of some of the main events in the Greek Sovereign debt crisis.[135]

October 2009

- A new Greek government is formed after the election, led by PASOK, which received 43.92% of the popular vote, and 160 of 300 parliament seats.

November 2009

- 5 Nov.: Update of government budget reveals an estimate deficit of 12.7% of GDP for 2009, more than twice the previously announced figure, and 4 times the initial (December 2008) estimate.

- 8 Nov.: Budget draft aims to cut deficit to 8.7% of GDP for 2010. Draft also projects total debt rising to 121% of GDP in 2010 from 113.4% in 2009.

December 2009

- 8 Dec.: Fitch Ratings cuts Greece's rating to BBB+ from A-, with a negative outlook.

- 14 Dec.: Greek PM Papandreou outlines first round of policies to cut deficit and regain investor trust.

- 16 Dec.: S&P cuts Greece's rating to BBB+ from A-.

- 22 Dec.: Moody's cuts Greece's rating to A2 from A1.

January 2010

- 14 Jan.: Greece unveils the Stability and Growth Program which aims to cut deficit from 12.7% in 2009 to 2.8% in 2012.

- Jan. xx: 5-year bond issue is five-times oversubscribed but yields and spreads rise.

February 2010

- 2 Feb.: Government extends public sector wage freeze to those earning less than EUR 2,000 a month.

- 3 Feb.: EU Commission backs Greece's Stability and Growth Program and urges it to cut its overall wage bill.

- 24 Feb.: One-day general strike against the austerity measures halts public services and transport system.

- 25 Feb.: EU mission in Athens with IMF experts delivers grim assessment of country's finances.

March 2010

- 5 Mar.: New public sector wage cuts and tax increases is passed and estimated to generate savings of EUR 4.8 bn. Measures include increasing VAT by 2% to 21%, cutting public sector salary bonuses by 30%, increases on fuel, tobacco and alcohol consumption taxes and freezing state-funded pensions in 2010.

- 11 Mar.: Public and private sector workers strike.

- 15 Mar.: EMU finance ministers agree on mechanism to help Greece but reveal no details.

- 18 Mar.: Papandreou warns Greece will not be able to cut deficit if borrowing costs remain as high as they are and may have to go to the IMF.

- 19 Mar.: European Commission President José Manuel Barroso urges EU member states to agree a standby aid package for Greece. Barroso says the EMU countries should be on stand by to make bilateral loans.

- 25 Mar.: ECB President Jean-Claude Trichet says his bank will extend softer rules on collateral (accepting BBB? instead of the standard A-) for longer (up to 2011) in order to avoid a situation where one ratings agency (Moody's) basically decides if an EMU country's bonds are eligible for use as ECB collateral.

- Mar.: €5bn in 10-year Greek bonds sold – orders for three times that amount are received.

April 2010

- 9 Apr.: Greek government announces that the deficit for the first trimester was reduced by 39,2%.[136] The news fails to impact the market, since it is ignored by the main financial media.

- 11 Apr.: EMU leaders agree bailout plan for Greece. Terms are announced for EUR 30 bn of bilateral loans (roughly 5% for a three-year loan). EMU countries will participate in the amount based on their ECB country keys. Rates for variable rate loans will be 3m-Euribor plus 300 bp + 100 bp for over three-year loans plus a one-off 50 bp charge for operating expenses. For fixed rate loans rates will be swap rate for the loan's maturity, plus the 300 bp (as in variable) plus the 100 bp for loans over three years plus the 50 bp charge.

- 13 Apr.: ECB voices its support for the rescue plan.

- 15 Apr.: Olli Rehn says there is no possibility of a Greek default and no doubt that Germany will participate in the bail out plan. In the mean time there had been serious objections from parts of German society to the country's participation in the Greek bail-out.

- Apr. Sale of more than 1.5 billion euros Greek Treasury bills met with "stronger-than-expected" demand, albeit at a high interest rate.

- 23 Apr.: Greece officially asks for the disbursement of money from the aid package effectively activating it.

- 27 Apr.: Standard and Poor's downgrades Greece's debt ratings below investment grade to junk bond status.

- 27 Apr.: S&P downgrades Portuguese debt two notches and issues negative outlook, warning that further downgrades to junk status are likely. Stock indices around the world drop two to six percent on the news.

- 28 Apr. S&P downgrades Spanish bonds from AAA to AA-

May 2010

- 1 May: Protests, yearly taking place for the day, this year add "the proposed austerity measures", in Athens.

- 2 May: Greece announces the latest, fourth, raft of austerity measures.

- 3 May: The ECB announces that it will accept Greek Government Bonds as collateral no matter what their rating is. This effectively means scrapping the BBB-floor in the case of Greece and increasing the likelihood of similar announcements in case other countries run the risk of being downgraded to junk status.[137]

- 4 May: First day of strikes against the austerity measures. Global stock markets react negatively to fears of contagion.[138]

- 5 May: General nationwide strike and demonstrations in two major cities in Greece turned violent. Three people were killed when a group of masked people threw petrol bombs in a Marfin Bank branch on Stadiou street.[139][140]

- 6 May: Concerns about the ability of the Eurozone to deal with a spreading crisis effectively caused a severe market sell off, particularly in the US where electronic trading glitches combined with a high volume sell off produced a nearly 1,000 point intra-day drop in the Dow Jones Industrial Average, before it recovered somewhat to close down 347.

- 7 May: Volatility continued to accelerate with an increasing CBOE VIX index and a major widening in currency spreads, particularly dollar-yen and dollar-euro.

- 8 May: Leaders of the eurozone countries resolved in Brussels to take drastic action to protect the euro from further market turmoil after approving a $100 billion bailout plan for Greece.[141]

- 20 May: Fourth strike in Greece against wage cuts.

- 24 May: Greek government is announcing deficit reduction by 41.5% for the first four months,[142] but the news again fails the main financial media.

- 29 May: Fitch downgrades Spanish government bonds one notch from AAA to AA+.[143]

June 2010

- 4 June: The Hungarian PM Viktor Orban's spokesman said it was not an exaggeration that the prospect of a national default is very real, although Moody's still affirmed that Hungary had a good record of paying its obligations.[144] The Euro fell to a four-year low[145] and major American markets fell more than 3%.

July 2010

- 5 July : The central Bank of Greece announced a reduction of central government cash deficit by 41.8%, for the first half-year 2010.[146]

EU emergency measures

On 9 May 2010 the 27 member states of the European Union agree to create the European Financial Stability Facility (EFSF), a legal instrument[147] aiming at preserving financial stability in Europe by providing financial assistance to eurozone states in difficulty.[148]

In order to reach these goals the Facility is devised in the form of a special purpose vehicle (SPV) that will sell bonds and use the money it raises to make loans up to a maximum of € 440 billion to eurozone nations in need. The bonds will be backed by guarantees given by the European Commission representing the whole EU, the eurozone member states, and the IMF. The new entity will sell debt only after an aid request is made by a country.[149]

The EFSF will be combined to a € 60 billion loan coming from the European financial stabilisation mechanism (reliant on guarantees given by the European Commission using the EU budget as collateral) and to a € 250 billion loan backed by the IMF in order to obtain a financial safety net up to € 750 billions.[150][151] The agreement allows the European Central Bank to start buying government debt which is expected to reduce bond yields.[152] (Greek bond yields fell from over 10% to just over 5%;[153] Asian bonds also fell with the EU bailout.[154])

The ECB has announced a series measures aimed at reducing volatility in the financial markets and at improving liquidity:[155]

- First, it began open market operations buying government and private debt securities.

- Second, it announced two 3-month and one 6-month full allotment of Long Term Refinancing Operations (LTRO's).

- Thirdly, it reactivated the dollar swap lines[156] with Federal Reserve support.[157]

Subsequently, the member banks of the European System of Central Banks started buying government debt.[158]

Stocks worldwide surged after this announcement as fears that the Greek debt crisis would spread subsided,[159] some rose the most in a year or more.[160] The Euro made its biggest gain in 18 months,[161] before falling to a new four-year low a week later.[162] Commodity prices also rose following the announcement.[163] The dollar Libor held at a nine-month high.[164] Default swaps also fell.[165] The VIX closed down a record almost 30%, after a record weekly rise the preceding week that prompted the bailout.[166]

Despite the moves by the EU, the European Commissioner for Economic and Financial Affairs, Olli Rehn, called for "absolutely necessary" deficit cuts by the heavily indebted countries of Spain and Portugal.[167] Private sector bankers and economists also warned that the threat from a double dip recession has not faded. Stephen Roach, chairman of Morgan Stanley Asia, warned about this threat saying "When you have a vulnerable post-crisis economic recovery and crises reverberating in the aftermath of that, you have some very serious risks to the global business cycle."[168] Nouriel Roubini said the new credit available to the heavily indebted countries did not equate to an immediate revival of economic fortunes: "While money is available now on the table, all this money is conditional on all these countries doing fiscal adjustment and structural reform."[169]

After initially falling to a four-year low early in the week following the announcement of the EU guarantee packages, the euro rose as hedge funds and other short-term traders unwound short positions and carry trades in the currency.[170]

See also

- Economy of Greece

- 2000s commodities boom

References

- ↑ Stefan Schultz (11 February 2010). "Five Threats to the Common Currency". Der Spiegel. http://www.spiegel.de/international/europe/0,1518,677214,00.html. Retrieved 28 April 2010.

- ↑ Peter Coy. "The Trillion-Dollar Treatment". http://www.businessweek.com/magazine/content/10_21/b4179006021713.htm.

- ↑ George Matlock (16 February 2010). "Peripheral euro zone government bond spreads widen". Reuters. http://www.reuters.com/article/idUSLDE61F0W720100216. Retrieved 28 April 2010.

- ↑ Bruce Walker (9 April 2010). The New American. http://www.thenewamerican.com/index.php/world-mainmenu-26/europe-mainmenu-35/3274-greek-debt-crisis-worsens. Retrieved 28 April 2010.

- ↑ Brian Blackstone, Tom Lauricella, and Neil Shah (5 February 2010). "Global Markets Shudder: Doubts About U.S. Economy and a Debt Crunch in Europe Jolt Hopes for a Recovery". The Wall Street Journal. http://online.wsj.com/article/SB10001424052748704041504575045743430262982.html. Retrieved 10 May 2010.

- ↑ "Greek/German bond yield spread more than 1,000 bps". Financialmirror.com. 28 April 2010. http://www.financialmirror.com/News/Cyprus_and_World_News/20151. Retrieved 5 May 2010.

- ↑ http://www.ft.com/cms/s/0/7d25573c-1ccc-11df-8d8e-00144feab49a.html

- ↑ 8.0 8.1 "Britain's deficit third worst in the world, table". The Daily Telegraph (London). 19 February 2010. http://www.telegraph.co.uk/finance/financetopics/financialcrisis/7269629/Britains-deficit-third-worst-in-the-world-table.html. Retrieved 29 April 2010.

- ↑ "Fiscal Deficit and Unemployment Rate, FT". http://blogs.ft.com/money-supply/files/2010/01/misery.gif. Retrieved 5 May 2010.

- ↑ "Timeline: Greece's economic crisis". Reuters. 3 February 2010. http://www.reuters.com/article/idUSTRE6124EL20100203. Retrieved 29 April 2010.

- ↑ Gabi Thesing and Flavia Krause-Jackson (3 May 2010). "Greece Gets $146 Billion Rescue in EU, IMF Package". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601087&sid=a9f8X9yDMcdI&pos=1. Retrieved 10 May 2010.

- ↑ "EU ministers offer 750bn-euro plan to support currency". BBC News. 10 May 2010. http://news.bbc.co.uk/1/hi/business/8671632.stm. Retrieved 11 May 2010.

- ↑ "Greece: Foreign Capital Inflows Up « Embassy of Greece in Poland Press & Communication Office". Greeceinfo.wordpress.com. 17 September 2009. http://greeceinfo.wordpress.com/2009/09/17/greece-foreign-capital-inflows-up/. Retrieved 5 May 2010.

- ↑ Floudas, Demetrius A. "The Greek Financial Crisis 2010: Chimerae and Pandaemonium". Hughes Hall Seminar Series, March 2010: University of Cambridge. http://www.talks.cam.ac.uk/talk/index/23660.

- ↑ "Back down to earth with a bang". Kathimerini (English Edition). 3 March 2010. http://www.ekathimerini.com/4dcgi/_w_articles_columns_1_08/03/2010_115465. Retrieved 12 May 2010.

- ↑ 16.0 16.1 "Onze questions-réponses sur la crise grecque – Economie – Nouvelobs.com". http://tempsreel.nouvelobs.com/actualite/economie20100429.OBS3199/onze-questions-reponses-sur-la-crise-grecque.html. Retrieved 2 May 2010.

- ↑ "EU Stats Office: Greek Economy Figures Unreliable – ABC News". http://abcnews.go.com/Business/wireStory?id=9541636. Retrieved 2 May 2010.

- ↑ "Rehn: No other state will need a bail-out – EU Observer". http://euobserver.com/19/30015. Retrieved 6 May 2010.

- ↑ "Greece Paid Goldman $300 Million To Help It Hide Its Ballooning Debts – Business Insider". http://www.businessinsider.com/henry-blodget-greece-paid-goldman-300-million-to-help-it-hide-its-ballooning-debts-2010-2. Retrieved 6 May 2010.

- ↑ "Wall St. Helped to Mask Debt Fueling Europe's Crisis". The New York Times. 14 February 2010. http://www.nytimes.com/2010/02/14/business/global/14debt.html?pagewanted=1&hp. Retrieved 6 May 2010.

- ↑ "Greece not alone in exploiting EU accounting flaws". Reuters. February 22, 2010. http://www.reuters.com/article/idUSTRE61L3EB20100222. Retrieved 20 August 2010.

- ↑ "Greece Pressed to Take Action on Economic Woes". New York Times. February 15, 2010. http://www.nytimes.com/2010/02/16/business/global/16euro.html?_r=1&adxnnl=1&ref=global&adxnnlx=1266321612-5V1rCpPd4RGVevbd8SGB2Q. Retrieved 20 August 2010.

- ↑ "Greece's sovereign-debt crunch: A very European crisis". http://www.economist.com/world/europe/displaystory.cfm?story_id=15452594. Retrieved 2 May 2010.

- ↑ "Greek Deficit Revised to 13.6%; Moody's Cuts Rating (Update2) – Bloomberg.com". http://www.bloomberg.com/apps/news?pid=20601068&sid=aUi3XLUwIIVA. Retrieved 2 May 2010.

- ↑ "Britain's deficit third worst in the world, table – Telegraph". The Daily Telegraph (London). 19 February 2010. http://www.telegraph.co.uk/finance/financetopics/financialcrisis/7269629/Britains-deficit-third-worst-in-the-world-table.html. Retrieved 2 May 2010.

- ↑ "Greek Debt Concerns Dominate – Who Will Be Next? – Seeking Alpha". http://seekingalpha.com/article/183820-greek-debt-concerns-dominate-who-will-be-next. Retrieved 2 May 2010.

- ↑ "Greek debt to reach 120.8 pct of GDP in '10 – draft". 5 November 2009. http://www.reuters.com/article/idUSATH00496420091105. Retrieved 2 May 2010.

- ↑ "Greece's sovereign-debt crisis: Still in a spin". http://www.economist.com/displaystory.cfm?story_id=15908288. Retrieved 2 May 2010.

- ↑ "Greeks and the state: an uncomfortable couple". Associated Press. 3 May 2010. http://news.yahoo.com/s/ap/20100503/ap_on_bi_ge/eu_unruly_greece.

- ↑ Greek bond auction provides some relief

- ↑ "FT.com / Capital Markets – Strong demand for 10-year Greek bond". http://www.ft.com/cms/s/0/245030a8-2773-11df-b0f1-00144feabdc0.html. Retrieved 2 May 2010.

- ↑ 32.0 32.1 Greek Debt Rating Cut to Junk Status, The New York Times, 27 April 2010

- ↑ "BBC News – Greek credit status downgraded to 'junk'". 27 April 2010. http://news.bbc.co.uk/2/hi/business/8647903.stm. Retrieved 2 May 2010.

- ↑ Greek bonds rated 'junk' by Standard & Poor's, BBC, 28 Apr. 2010

- ↑ "Timeline: Greece's economic crisis". 3 March 2010. http://www.reuters.com/article/idUSTRE62230T20100303. Retrieved 2 May 2010.

- ↑ "ECB: Long-term interest rates". http://www.ecb.int/stats/money/long/html/index.en.html. Retrieved 2 May 2010.

- ↑ Lauricella, Tom (22 April 2010). "Investors Desert Greek Bond Market – WSJ.com". The Wall Street Journal. http://online.wsj.com/article/SB10001424052748704133804575198390974245622.html. Retrieved 5 May 2010.

- ↑ |http://www.bloomberg.com/apps/quote?ticker=GGGB10YR%3AIND|

- ↑ "ECB suspends rating limits on Greek debt | News". Business Spectator. 22 October 2007. http://www.businessspectator.com.au/bs.nsf/Article/ECB-suspends-rating-limits-on-Greek-debt-549GS?opendocument&src=rss. Retrieved 5 May 2010.

- ↑ "UPDATE 3-ECB will accept even junk-rated Greek bonds". Reuters. 3 May 2010. http://www.reuters.com/article/idUSLDE6420A920100503. Retrieved 5 May 2010.

- ↑ "Trichet May Rewrite ECB Rule Book to Tame Greek Risk (Update2)". Bloomberg. 30 May 2005. http://www.bloomberg.com/apps/news?pid=20601087&sid=aTTlZki30xTI&pos=3. Retrieved 5 May 2010.

- ↑ Ingrid Melander (5 March 2010). "Greek parliament passes austerity bill". Reuters. http://www.reuters.com/article/idUSATH00527020100305?type=usDollarRpt. Retrieved 6 May 2010.

- ↑ "Greece seeks activation of €45 billion aid package". Irish Times. 23 April 2010. http://www.irishtimes.com/newspaper/breaking/2010/0423/breaking28.html. Retrieved 6 May 2010.

- ↑ "IMF head Strauss-Kahn says fund will 'move expeditiously' on Greek bailout request". Today. http://www.todayonline.com/BreakingNews/EDC100423-0000281/IMF-head-Strauss-Kahn-says-fund-will-move-expeditiously-on-Greek-bailout-request.

- ↑ "Greek minister says IMF debt talks are 'going well'". BBC. 25 April 2010. http://news.bbc.co.uk/2/hi/8642941.stm. Retrieved 6 May 2010.

- ↑ Christos Ziotis and Natalie Weeks (20 April 2010). "Greek Bailout Talks Could Take Three Weeks; Bond Payment Looms". Bloomberg. http://www.businessweek.com/news/2010-04-20/greek-bailout-talks-could-take-three-weeks-bond-payment-looms.html. Retrieved 6 May 2010.

- ↑ Steven Erlanger (24 March 2010). "Europe Looks at the I.M.F. With Unease as Greece Struggles". The New York Times. http://www.nytimes.com/2010/03/25/world/europe/25europe.html. Retrieved 6 May 2010.

- ↑ Gabi Thesing and Flavia Krause-Jackson (3 May 2010). "Greece Gets $146 Billion Rescue in EU, IMF Package". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601087&sid=a9f8X9yDMcdI. Retrieved 6 May 2010.

- ↑ Kerin Hope (2 May 2010). "EU puts positive spin on Greek rescue". Financial Times. http://www.ft.com/cms/s/0/08a87e4e-55c4-11df-b835-00144feab49a.html. Retrieved 6 May 2010.

- ↑ (Greek)"Fourth raft of new measures". In.gr. 2 May 2010. http://www.in.gr/news/article.asp?lngEntityID=1132263&lngDtrID=251. Retrieved 6 May 2010.

- ↑ 51.0 51.1 Friedman, Thomas L. (14 May 2010). "Greece's newest odyssey". San Diego, California: San Diego Union-Tribune. pp. B6. http://www.nytimes.com/2010/05/12/opinion/12friedman.html.

- ↑ Judy Dempsey (5 May 2010). "Three Reported Killed in Greek Protests". The New York Times. http://www.nytimes.com/2010/05/06/world/europe/06greece.html?src=me. Retrieved 5 May 2010.

- ↑ Global Economics Flash, Greek Sovereign Debt Restructuring Delayed but Not Avoided for Long, 5 May 2010, "The amount of fiscal tightening announced over the next three years is even larger than we expected: €30 bn worth of spending cuts and tax increases, around 12.5% of the 2009 Greek GDP, and an even higher percentage of the average annual GDP over the next three years (2010–2012). With 5 percentage points of GDP tightening in 2010 and 4 percentage points of GDP tightening in 2011, the economy should contract quite sharply – between 3 and 4 percent this year and probably another 1 or 2 percent contraction in 2011."

- ↑ "'De-facto' Greek default 80% sure: Global Insight – MarketWatch". MarketWatch. 28 April 2010. http://www.marketwatch.com/story/de-facto-greek-default-80-sure-global-insight-2010-04-28. Retrieved 2 May 2010.

- ↑ "cnbc: countries probable to default". CNBC. 1 March 2010. http://www.cnbc.com/id/34465366/Government_Debt_Issuers_Most_Likely_to_Default?slide=3.

- ↑ "Greece Turning Viral Sparks Search for EU Solutions (Update2) – Bloomberg.com". Bloomberg. 29 April 2010. http://www.bloomberg.com/apps/news?pid=20601010&sid=aCW0uYHW707A. Retrieved 2 May 2010.

- ↑ "Roubini on Greece | Analysis & Opinion |". Blogs.reuters.com. 27 April 2010. http://blogs.reuters.com/felix-salmon/2010/04/28/roubini-on-greece/. Retrieved 5 May 2010.

- ↑ Reuters-Fed's Balance Sheet Liability Hits Record-January 2010

- ↑ "UPDATE: Greek, Spain, Portugal Debt Insurance Costs Fall Sharply – WSJ.com". The Wall Street Journal. 29 April 2010. http://online.wsj.com/article/BT-CO-20100429-708368.html?mod=rss_Bonds. Retrieved 2 May 2010.

- ↑ "BBC News – Q&A: Greece's economic woes". BBC. 30 April 2010. http://news.bbc.co.uk/2/hi/business/8508136.stm. Retrieved 2 May 2010.

- ↑ "Italy Not Among Most at Risk in Crisis, Moody's Says (Update1)". Bloomberg. 7 May 2010. http://www.bloomberg.com/apps/news?pid=20601092&sid=ayL4p4wwZcb4. Retrieved 10 May 2010.

- ↑ http://www.ft.com/cms/s/478fc9da-57dd-11df-855b-00144feab49a,Authorised=false.html?_i_location=http%3A%2F%2Fwww.ft.com%2Fcms%2Fs%2F0%2F478fc9da-57dd-11df-855b-00144feab49a.html&_i_referer=http%3A%2F%2Fwww.burbuja.info%2Finmobiliaria%2Fburbuja-inmobiliaria%2F157400-el-fmi-viene-en-mayo-espana.html

- ↑ http://www.finfacts.ie/irishfinancenews/article_1019320.shtml.

- ↑ Murado, Miguel-Anxo (1 May 2010). "Repeat with us: Spain is not Greece". The Guardian (London). http://www.guardian.co.uk/commentisfree/2010/may/01/spain-economy-greece-crisis.

- ↑ "Daniel Gros: The Euro Can Survive a Greek Default – WSJ.com". The Wall Street Journal. * 29 APRIL 2010. http://online.wsj.com/article/SB10001424052748704423504575212282125560338.html?mod=WSJ_Opinion_LEFTTopOpinion. Retrieved 2 May 2010.

- ↑ "Greece announces new austerity measures". Xinhua. 010-03-03. http://news.xinhuanet.com/english2010/world/2010-03/03/c_13196072.htm. Retrieved 2 May 2010.

- ↑ "The PIIGS Problem: Maginot Line Economics » New Deal 2.0". New Deal 2.0. 04/12/2010. http://www.newdeal20.org/2010/04/12/the-piigs-problem-maginot-line-economics-9697/. Retrieved 2 May 2010.

- ↑ Stiglitz, Joseph (25 January 2010). "A principled Europe would not leave Greece to bleed". The Guardian (London). http://www.guardian.co.uk/commentisfree/2010/jan/25/principled-europe-not-let-greece-bleed. Retrieved 12 May 2010.

- ↑ "FT.com / Comment / Opinion – A euro exit is the only way out for Greece". Financial Times. 25 March 2010. http://www.ft.com/cms/s/0/6a618b7a-3847-11df-8420-00144feabdc0.html. Retrieved 2 May 2010.

- ↑ Abigail Moses (26 April 2010). "Greek Contagion Concern Spurs Sovereign Default Risk to Record". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601087&sid=afoymQhJ0MqY. Retrieved 30 April 2010.

- ↑ O'Grady, Sean; Lichfield, John (7 May 2010), "'Very real' threat that Greek contagion could spread to Britain", The Independent (London), http://www.independent.co.uk/news/business/news/very-real-threat-that-greek-contagion-could-spread-to-britain-1965610.html.

- ↑ Duncan, Hugo (8 February 2010), "Pound dives amid fear of UK debt crisis", London Evening Standard, http://www.thisislondon.co.uk/standard-business/article-23803397-pound-dives-amid-fear-of-uk-debt-crisis.do.

- ↑ The Irish Times, 28 April 2010, p.18.

- ↑ Irish Times, 19 May 2010, p.15.

- ↑ "Turmoil is fiscal warning to others", Financial Times, http://www.ft.com/cms/s/0/e0e95c92-5326-11df-813e-00144feab49a.html, retrieved 2 May 2010

- ↑ Allen, Katie (5 May 2010), "UK budget deficit 'to surpass Greece's as worst in EU'", The Guardian (London), http://www.guardian.co.uk/business/2010/may/05/uk-budget-deficit-worse-than-greece.

- ↑ [shttp://www.ft.com/cms/s/0/ce1f9b80-5d5d-11df-8373-00144feab49a.html "Need for big cuts dawns on Spain"], Financial Time, 12 May 2010, shttp://www.ft.com/cms/s/0/ce1f9b80-5d5d-11df-8373-00144feab49a.html, retrieved 12 May 2010

- ↑ Obama calls for 'resolute' spending cuts in Spain, EUObserver, 12 May 2010, http://euobserver.com/9/30064, retrieved 12 May 2010

- ↑ Spain Lowers Public Wages After EU Seeks Deeper Cuts, Bloomberg Business Week, 12 May 2010, http://www.businessweek.com/news/2010-05-12/spain-lowers-public-wages-after-eu-seeks-deeper-cuts-update1-.html, retrieved 12 May 2010

- ↑ "A Greek crisis is coming to America". Financial Times. 10 February 2010. http://www.ft.com/cms/s/0/f90bca10-1679-11df-bf44-00144feab49a.html.

- ↑ "Deconstructing Europe: How A €20 Billion Liquidity Crisis Is Set To Become A €1.6 Trillion Funding Crisis". Zero Hedge. 9 February 2010. http://www.zerohedge.com/article/deconstructing-europe-how-%E2%82%AC20-billion-liquidity-crisis-set-become-%E2%82%AC16-trillion-funding-crisi.

- ↑ Grice, Dylan (8 March 2010), Popular Delusions newsletter, Société Générale

- ↑ Kamelia Angelova (5 February 2010). "Niall Ferguson: The Next Greece? It's The US!". Businessinsider.com. http://www.businessinsider.com/niall-ferguson-us-finances-are-not-much-better-than-those-of-greece-2010-2. Retrieved 5 May 2010.

- ↑ "/ Reports – Sovereigns: Debt levels raise fears of further downgrades". Financial Times. 24 February 2010. http://www.ft.com/cms/s/0/599d9f3c-2009-11df-81a2-00144feab49a.html. Retrieved 5 May 2010.

- ↑ "/ Comment / Opinion – A Greek crisis is coming to America". Financial Times. 10 February 2010. http://www.ft.com/cms/s/0/f90bca10-1679-11df-bf44-00144feab49a.html. Retrieved 5 May 2010.

- ↑ "Fear returns". The Economist. 27 May 2010. http://www.economist.com/opinion/displaystory.cfm?story_id=16216363. Retrieved 27 May 2010.

- ↑ "The European Financial Stability Facility'". http://www.efsf.europa.eu/. Retrieved 15 July 2010.

- ↑ " – Elcano". http://www.realinstitutoelcano.org/wps/portal/rielcano_eng/Content?WCM_GLOBAL_CONTEXT=/elcano/elcano_in/zonas_in/international+economy/ari31-2009. Retrieved 2 May 2010.

- ↑ (English) see M. Nicolas Firzli, 'Greece and the EU Debt Crisis', http://www.canadianeuropean.com/yahoo_site_admin/assets/docs/Greece__the_EU_Debt_Crisis_VN__Al-Nahar_Feb-March_2010.7383827.pdf, retrieved 15 March 2010

- ↑ (French) see M. Nicolas Firzli, 'Bank Regulation and Financial Orthodoxy: the Lessons from the Glass-Steagall Act', http://www.canadianeuropean.com/yahoo_site_admin/assets/docs/Bank_Regulation_and_Financial_Orthodoxy__RAF__Jan_2010.784613.pdf, retrieved 4 January 2010

- ↑ 'Merkel Economy Adviser Says Greece Bailout Should Bring Penalty', http://www.businessweek.com/news/2010-02-15/merkel-economy-adviser-says-greece-bailout-should-bring-penalty.html, retrieved 15 February 2010

- ↑ Kaletsky, Anatole (11 February 2010), "'Greek tragedy won't end in the euro's death'", The Times (London), http://www.timesonline.co.uk/tol/comment/columnists/anatole_kaletsky/article7022509.ece, retrieved 15 February 2010

- ↑ "The euro's existential worries". The Economist. 6 May 2010. http://www.economist.com/world/europe/displayStory.cfm?story_id=16060063. Retrieved 12 May 2010.

- ↑ Grabel, Ilene (1 May 1998). "Foreign Policy in Focus | Portfolio Investment". Fpif.org. http://www.fpif.org/reports/portfolio_investment. Retrieved 5 May 2010.

- ↑ "P2P Foundation » Blog Archive » Defending Greece against failed neoliberal policies through the creation of sovereign debt for the productive economy". Blog.p2pfoundation.net. 6 February 2010. http://blog.p2pfoundation.net/defending-greece-against-failed-neoliberal-policies-through-the-creation-of-sovereign-debt-for-the-productive-economy/2010/02/06. Retrieved 5 May 2010.

- ↑ Pearlstein, Steven (21 May 2010). "Forget Greece: Europe's Real Problem is Germany", Washington Post

- ↑ CIA Factbook-Data Retrieved 21 May 2010

- ↑ Ben Bernanke-U.S. Federal Reserve-The Global Savings Glut and U.S. Current Account Balance-March 2005

- ↑ NYT-Paul Krugman-Revenge of the Glut-March 2009

- ↑ Krugman, Paul Saving Asia: It's Time to Get Radical, Fortune September, 1998

- ↑ 'Failure is not an option when it comes to Greece', http://www.thenational.ae/apps/pbcs.dll/article?AID=/20100222/BUSINESSCOLUMNISTS/702219964/1058/BUSINESS&template=columnists, retrieved 24 February 2010

- ↑ 102.0 102.1 102.2 "Credit-rating agencies under fire in Europe crisis – Yahoo! News". http://news.yahoo.com/s/ap/20100429/ap_on_bi_ge/us_ratings_agencies. Retrieved 2 May 2010.

- ↑ 103.0 103.1 Waterfield, Bruno (28 April 2010). "European Commission's angry warning to credit rating agencies as debt crisis deepens – Telegraph". The Daily Telegraph (London). http://www.telegraph.co.uk/news/worldnews/europe/greece/7646434/European-Commissions-angry-warning-to-credit-rating-agencies-as-debt-crisis-deepens.html. Retrieved 2 May 2010.

- ↑ Wachman, Richard (28 Apr. 2010). "Greece debt crisis: the role of credit rating agencies". The Guardian (London). http://www.guardian.co.uk/business/2010/apr/28/greece-debt-crisis-standard-poor-credit-agencies. Retrieved 2 May 2010.

- ↑ Lowenstein, Roger (27 Apr. 2008). "Moody's – Credit Rating – Mortgages – Investments – Subprime Mortgages – New York Times". New York Times. http://www.nytimes.com/2008/04/27/magazine/27Credit-t.html. Retrieved 2 May 2010.

- ↑ "FT.com / US / Politics & Foreign policy – Moody's chief admits failure over crisis". Financial Times. http://www.ft.com/cms/s/0/9456f280-4f03-11df-b8f4-00144feab49a.html. Retrieved 2 May 2010.

- ↑ "Iceland row puts rating agencies in firing line". http://www.thisislondon.co.uk/standard-business/article-23572533-iceland-row-puts-rating-agencies-in-firing-line.do. Retrieved 2 May 2010.

- ↑ "BBC NEWS". BBC News. 28 January 2009. http://news.bbc.co.uk/2/hi/business/7856929.stm. Retrieved 2 May 2010.

- ↑ "Greek crisis: the world would be a better place without credit rating agencies – Telegraph Blogs". Daily Telegraph (UK). 28 April 2010. http://blogs.telegraph.co.uk/finance/jeremywarner/100005241/the-world-would-be-a-better-place-without-credit-rating-agencies/. Retrieved 2 May 2010.

- ↑ "Are the ratings agencies credit worthy?". CNN. http://edition.cnn.com/2010/BUSINESS/05/04/credit.ratings.agencies/index.html?hpt=C1.

- ↑ 111.0 111.1 "FT.com / Europe – Rethink on rating agencies urged". Financial Times. http://www.ft.com/cms/s/0/e2e2f732-53bd-11df-aba0-00144feab49a.html. Retrieved 2 May 2010.

- ↑ "EU Gets Tough on Credit-Rating Agencies". BusinessWeek. http://www.businessweek.com/globalbiz/content/apr2009/gb20090424_056975.htm. Retrieved 2 May 2010.

- ↑ "European indecision: Why is Germany talking about a European Monetary Fund?". http://www.economist.com/blogs/charlemagne/2010/03/european_indecision?page=1. Retrieved 2 May 2010.

- ↑ 11:17 a.m. Today11:17 a.m. 5 May 2010 (5 March 2010). "ECB suspends rating threshold for Greece debt". MarketWatch. http://www.marketwatch.com/story/ecb-suspends-rating-threshold-for-greek-debt-2010-05-03-3400. Retrieved 5 May 2010.

- ↑ "euro zone rumours: There is no conspiracy to kill the euro". The Economist. http://www.economist.com/blogs/charlemagne/2010/02/euro_zone_rumours. Retrieved 2 May 2010.

- ↑ "Greek Debt Crisis Worsens". http://www.thenewamerican.com/index.php/world-mainmenu-26/europe-mainmenu-35/3274-greek-debt-crisis-worsens. Retrieved 2 May 2010.

- ↑ Tremlett, Giles (14 February 2010). "Anglo-Saxon media out to sink us, says Spain". The Guardian (London). http://www.guardian.co.uk/world/2010/feb/14/jose-zapatero-media-spain-recession. Retrieved 2 May 2010.

- ↑ "Spain and the Anglo-Saxon press: Spain shoots the messenger". The Economist. http://www.economist.com/blogs/charlemagne/2010/02/spain_and_anglo-saxon_press. Retrieved 2 May 2010.

- ↑ "Spanish Intelligence Investigating “Anglo-Saxon” Media « The Washington Independent". http://washingtonindependent.com/76705/spanish-intelligence-investigating-anglo-saxon-media. Retrieved 2 May 2010.

- ↑ "Spanish intelligence probe 'debt attacks' blamed for sabotaging country's economy". Daily Mail (UK). http://www.dailymail.co.uk/news/worldnews/article-1251136/Spanish-intelligence-probe-debt-attacks-blamed-sabotaging-countrys-economy.html. Retrieved 2 May 2010.

- ↑ "A Media Plot against Madrid?: Spanish Intelligence Reportedly Probing 'Attacks' on Economy". Der Spiegel. http://www.spiegel.de/international/europe/0,1518,677904,00.html. Retrieved 2 May 2010.

- ↑ Roberts, Martin (14 February 2010). "Spanish intelligence probing debt attacks-report". http://www.reuters.com/article/idUSLDE61D04V20100214. Retrieved 2 May 2010.

- ↑ Cendrowicz, Leo (26 February 2010). "Conspiracists Blame Anglo-Saxons, Others for Euro Crisis". Time. http://www.time.com/time/world/article/0,8599,1968308,00.html. Retrieved 2 May 2010.

- ↑ Barbara Kollmeyer (15 February 2010). "Spanish secret service said to probe market swings". MarketWatch. http://www.marketwatch.com/story/spanish-secret-service-said-to-probe-market-swings-2010-02-15. Retrieved 13 May 2010.

- ↑ Gavin Hewitt (16 February 2010). "Conspiracy and the euro". BBC News. http://www.bbc.co.uk/blogs/thereporters/gavinhewitt/2010/02/conspiracy_and_the_euro.html. Retrieved 13 May 2010.

- ↑ Larry Elliot (28 January 2009). "London School of Economics' Sir Howard Davies tells of need for painful correction". The Guardian (London). http://www.guardian.co.uk/business/2009/jan/28/davies-global-economy-davos. Retrieved 13 May 2010.

- ↑ "Euro area balance of payments (December 2009 and preliminary overall results for 2009)". European Central Bank. 19 February 2010. http://www.ecb.europa.eu/press/pr/stats/bop/2010/html/bp100219.en.html. Retrieved 13 May 2010.

- ↑ Larry Elliot (28 January 2010). "No EU bailout for Greece as Papandreou promises to "put our house in order"". The Guardian (London). http://www.guardian.co.uk/business/2010/jan/28/greece-papandreou-eurozone. Retrieved 13 May 2010.

- ↑ Sean O'Grady (2 March 2010). "Soros hedge fund bets on demise of the euro". The Independent (London). http://www.independent.co.uk/news/business/news/soros-hedge-fund-bets-on-demise-of-the-euro-1914356.html. Retrieved 11 May 2010.

- ↑ Alex Stevenson (2 March 2010). "Soros and the bullion bubble". FT Alphaville. http://ftalphaville.ft.com/blog/2010/03/02/162286/soros-and-the-bullion-bubble/. Retrieved 11 May 2010.

- ↑ Donahue, Patrick (23 February 2010). "Merkel Slams Euro Speculation, Warns of 'Resentment'". BusinessWeek. http://www.businessweek.com/news/2010-02-23/merkel-slams-euro-speculation-warns-of-resentment-update1-.html. Retrieved 11 May 2010.

- ↑ "Kevin Connor: Goldman's Role in Greek Crisis Is Proving Too Ugly to Ignore". Huffington Post. 27 February 2010. http://www.huffingtonpost.com/kevin-connor/goldmans-role-in-greek-cr_b_479511.html. Retrieved 2 May 2010.

- ↑ Andrew Clark, Heather Stewart, and Elena Moya (26 February 2010). "Goldman Sachs faces Fed inquiry over Greek crisis". The Guardian (London). http://www.guardian.co.uk/business/2010/feb/25/markets-pressure-greece-cut-spending. Retrieved 11 May 2010.

- ↑ Wearden, Graeme (19 May 2010). "European debt crisis: Markets fall as Germany bans 'naked short-selling'". The Guardian (UK). http://www.guardian.co.uk/business/2010/may/19/debt-crisis-markets-fall-germany-naked-short-selling. Retrieved 27 May 2010.

- ↑ "Reuters Timeline of Greek Crisis". Reuters. 16 April 2010. http://www.reuters.com/article/idUSLDE6351JU20100416. Retrieved 5 May 2010.

- ↑ publisher = To Vima News "ToVima: Greek deficit reduction for Q1". 9 April 2010. http://www.tovima.gr/default.asp?pid=2&artid=324738&ct=3&dt=09/04/2010 publisher = To Vima News.

- ↑ "ECB extends financial lifeline to Greece". Financial Times. http://www.ft.com/cms/s/0/1d1c4b0c-5683-11df-aa89-00144feab49a.html. Retrieved 4 May 2010.

- ↑ "World shares dive as Greeks strike over cuts". The Times (UK). 4 May 2010. http://business.timesonline.co.uk/tol/business/economics/article7115884.ece. Retrieved 5 May 2010.

- ↑ "Three dead as Greece protest turns violent". BBC News. 5 May 2010. http://news.bbc.co.uk/2/hi/8661385.stm. Retrieved 5 May 2010.

- ↑ Bilefsky, Dan (5 May 2010). "Three Reported Killed in Greek Protests". The New York Times. http://www.nytimes.com/2010/05/06/world/europe/06greece.html. Retrieved 7 May 2010.

- ↑ Lauren Frayer, "Europe Tries to Calm Fears Over Greek Debt Crisis", AOL News. Retrieved 9 May 2010.

- ↑ "Skai news: Greek government deficit reduction for first 4 months". 21 May 2010.

- ↑ Duarte, E and Ross-Thomas, E (29 May 2010). "Spain Loses AAA Rating at Fitch as Europe Battles Debt Crisis". Bloomberg. http://www.bloomberg.com/apps/news?pid=20601010&sid=a5vlmlmZJB2s. Retrieved 9 May 2010.

- ↑ http://www.bloomberg.com/apps/news?pid=20601087&sid=aSvd4abNVV2E&pos=7

- ↑ http://www.bloomberg.com/apps/news?pid=20601087&sid=axTTiSuX3gvc&pos=5

- ↑ "Greece announces deficit reduction by 41.8%". Bank of Greece. 5 July 2010. http://www.bankofgreece.gr/Pages/en/Bank/News/PressReleases/DispItem.aspx?Item_ID=3359&List_ID=1af869f3-57fb-4de6-b9ae-bdfd83c66c95&Filter_by=DT. Retrieved 6 July 2010.

- ↑ [1] "The European Financial Stability Facility (EFSF), a legal instrument agreed by finance ministers earlier this month following the risk of Greece's debt crisis spreading to other weak economies."

- ↑ [2] "The 27 Member States agreed on 9 May 2010 that the Commission will be allowed to be tasked by the euro area Member States in the context of the assistance decided through a special purpose vehicle (the European Financial Stability Facility (EFSF)) up to EUR 440 billion and aiming at preserving financial stability in Europe. For the purposes of this support, the euro area Member States entrust the Commission, where appropriate in liaison with the ECB, with the task of:

(i) negotiating and signing on their behalf after their approval the memoranda of understanding related to this support;

(ii) providing proposals to them on the loan facility agreements to be signed with the beneficiary Member State(s);

(iii) assessing the fulfilment of the conditionality laid down in the memoranda of understanding;

(iv) providing input, together with the EIB, to further discussions and decisions in the Eurogroup on EFSF related matters and, in a transitional phase, in which the EFSF is not yet fully operational, on building up its administrative and operational capacities.

In addition, the Commission may be entrusted with certain additional tasks relating to the implementation of the support in accordance with the framework agreement to be concluded between the EFSF and the euro area Member States. The Commission shall also ensure consistency between EFSF operations and other operations of assistance by the EU.

The role of the Commission will not imply an increase in the expenditure of the Commission or of any other item of expenditure under the EU budget.

The Commission and the ECB are invited to nominate an observer to the Board of Directors of the EFSF." - ↑ [3] "8 June (Bloomberg) -- European finance ministers put the finishing touches on a rescue fund being backed by 440 billion euros ($524 billion) in national guarantees, seeking to halt the spread of Greece’s debt crisis. The European Financial Stability Facility would sell bonds backed by the guarantees and use the money it raises to make loans to euro-area nations in need, the finance ministers agreed yesterday in Luxembourg. The new entity would sell debt only after an aid request is made by a country."

- ↑ [4] "Media reports said that Spain would ask for support from two EU funds for eurozone governments in financial difficulty: a €60bn ‘European financial stabilisation mechanism', which is reliant on guarantees from the EU budget."

- ↑ [5] "The EFSF is expected to start operations in a few weeks, as soon as national parliaments representing 90 per cent of the fund's shareholding have approved it. At that point, all eurozone governments will be obliged to issue guarantees for the EFSF's debt instruments. If a country should need emergency funds before then, it can turn to a €60bn balance of payments facility that is under the European Commission's authority and uses the EU budget as collateral. This, plus the availability of up to €250bn in International Monetary Fund loans, makes up the €750bn package."

- ↑ "Shares and oil prices surge after EU loan deal". BBC. 10 May 2010. http://news.bbc.co.uk/2/hi/business/10104140.stm. Retrieved 10 May 2010.

- ↑ Stocks, Commodities, Greek Bonds Rally on European Loan Package

- ↑ Asian Bond Risk Tumbles Most in 18 Months on EU Loan Package

- ↑ "ECB decides on measures to address severe tensions in financial markets". ECB. 10 May 2010. http://www.ecb.int/press/pr/date/2010/html/pr100510.en.html. Retrieved 21 May 2010.

- ↑ "ECB: ECB decides on measures to address severe tensions in financial markets". http://www.ecb.int/press/pr/date/2010/html/pr100510.en.html. Retrieved 10 May 2010.

- ↑ Fed Restarts Currency Swaps as EU Debt Crisis Flares

- ↑ Euro-Area Central Banks Are Buying Government Bonds

- ↑ "European Markets Surge". The Wall Street Journal. 10 May 2010. http://online.wsj.com/article/SB10001424052748703880304575235462819341480.htm. Retrieved 10 May 2010.

- ↑ European Shares Jump Most in 17 Months as EU Pledges Loan Fund

- ↑ Traynor, Ian (10 May 2010). "Euro strikes back with biggest gamble in its 11-year history". The Guardian (UK). http://www.guardian.co.uk/world/2010/may/10/euro-debt-crisis-rescue-package. Retrieved 10 May 2010.

- ↑ Wearden, Graeme; Kollewe, Julia (17 May 2010). "Euro hits four-year low on fears debt crisis will spread". The Guardian (UK). http://www.guardian.co.uk/business/2010/may/17/euro-four-year-low-debt-crisis.

- ↑ Oil, Copper, Nickel Jump on European Bailout Plan; Gold Drops

- ↑ Dollar Libor Holds Near Nine-Month High After EU Aid

- ↑ Default Swaps Tumble After EU Goes 'All In': Credit Markets

- ↑ VIX Plunges by Record 36% as Stocks Soar on European Loan Plan

- ↑ Rehn Says Deficit Cuts Absolutely Necessary in Spain, Portugal

- ↑ Roach Says Debt Crisis Raises Risk of 'Double Dip' Recession

- ↑ Roubini Says European Resolution an 'Open Question': Tom Keene

- ↑ Kitano, Masayuki (21 May 2010). "Euro surges in short-covering rally, Aussie soars". Reuters. http://uk.finance.yahoo.com/news/forex-euro-surges-in-short-covering-rally-aussie-soars-targetukfocus-163f24240f58.html. Retrieved 21 May 2010.

External links

- New York Times Map of European Debts

- Protests in Greece in Response to Severe Austerity Measures in EU, IMF Bailout – video report by Democracy Now!

- 'The Greek Crisis – Politics, Economics, Ethics' Audio podcast of debate held at Birkbeck College University of London on 5 May 2010

- 'Eurozone in Crisis: Reform or Exit?' Audio podcast of debate held at Birkbeck College Univerity of London on 2 June 2010

- NYT Diagram – Interlocking Debt Positions of European Countries – 1 May 2010

- Argentina: Life After Default Article comparing the Argentine financial crisis of 2002 with the current situation in Greece

- Google - public data: Government Debt in Europe

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||