Competition between Airbus and Boeing

Competition between Airbus and Boeing (sometimes referred to as the "Airliner Wars") is a result of the two companies' domination of the large jet airliner market since the 1990s, which is itself a consequence of numerous corporate failures and mergers within the global aerospace industry over the years. Airbus began its life as a consortium, whereas Boeing took over its former arch-rival, McDonnell Douglas, in 1997. Other manufacturers, such as Lockheed and Convair in the USA and Dornier and Fokker in Europe, have pulled out of the civil aviation market after disappointing sales figures and economic problems. The collapse of the Eastern Bloc and its trade organisation Comecon around 1990 has put the former Soviet aircraft industry in a disadvantaged position, although Antonov, Ilyushin, Sukhoi, Tupolev and Yakovlev develop new aircraft and gain a small market share. All this has left Boeing and Airbus in a near-duopoly in the global market for large commercial jets comprising narrow-body aircraft, wide-body aircraft and jumbo jets. However, Embraer has gained market share with their narrow-body aircraft in the Embraer E-jets series. There is also a similar competition in regional jet manufacturing between Bombardier Aerospace and Embraer.

In the decade between 2000 and 2009 Airbus received 6,452 orders, while Boeing received 5,927. Airbus had higher deliveries between 2003 and 2009, but fell slightly short of Boeing's deliveries, delivering 3,810 aircraft compared to Boeing's 3,950. The competition is intense, and each company regularly accuses the other of receiving unfair state aid from their respective governments.

Competition by product

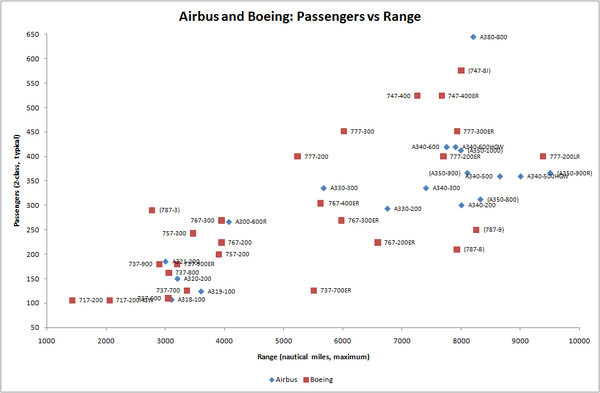

Range overlap

Though both manufacturers have a broad product range in various segments from single-aisle to wide-body, manufacturers' offerings do not always compete head-to-head. As listed below they respond with slightly different models.

- The Airbus A380, for example, is substantially bigger than the Boeing 747.

- The Airbus A350XWB competes with the high end of the Boeing 787 and the low end of the Boeing 777.

- The Airbus A320 is bigger than the 737-700 but smaller than the 737-800.

- The Airbus A321 is bigger than the 737-900 but smaller than the previous Boeing 757-200.

- The Airbus A330-200 competes with the smaller Boeing 767-300ER.

Airlines can use this as a benefit since they get a more complete product range from 100 seats to 500 seats than if both companies offered identical aircraft.

Passengers/range km (statute miles) for all models

| 2,645 to 3,185 (2400 sm) | 5,600 to 5,900 (3500 sm) | 6,800 to 7,700 (4500 sm) | 9,000 to 10,200 (5900 sm) | 10,500 to 11,300 (6800 sm) | 12,250 to 12,500 (7700 sm) | 13,300 to 13,900 (8500 sm) | 14,200 to 14,800 (9000 sm) | 14,900 to 15,200 (9300 sm) | 15,400 to 16,000 (9800 sm) | 16,700 to 17,400 (10500 sm) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 100-139 | (B717-200) | A318-100 B737-600 | |||||||||

| 140-156 | B737-700 | A319-100 | B737-700ER | ||||||||

| 148-189 | B737-800 A320-200 | ||||||||||

| 177-255 | A321-200 B737-900 | (B757-200) | (A310-200) (A310-300) | B767-300ER | B767-200ER | B787-8 | |||||

| 243-375 | (B757-300) | B767-400ER B747SP | |||||||||

| 253-300 | (A300) | (A300-600) | A330-200 | A340-200 | A350-800 B787-9 | ||||||

| 295-440 | B787-3 | B777-200 | A330-300 | A340-300 | B777-200ER | A350-900 | B777-200LR | ||||

| 313-366 | A340-500 | A340-500HGW A350-900R | |||||||||

| 358-550 | B747-100SR B747-300SR | B747-100 | B777-300 | B747-200 | B777-300ER A350-1000 | ||||||

| 380-419 | A340-600 A340-600HGW | ||||||||||

| 410-568 | B747-400 | B747-400ER | |||||||||

| <467 | B747-8 | ||||||||||

| 525-853 | A380 |

Airbus A320 vs Boeing 737

| Airbus A320 vs 737 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Airbus A330 Series | Boeing 767 Series | Boeing 777 Series | ||||||

|---|---|---|---|---|---|---|---|---|

| A330-200 | A330-300 | A330-F | 767-200ER | 767-300ER | 767-300-F | 767-400ER | 777-200LR | |

| Two | Cockpit crew | Two | ||||||

| 253 (3 cl.) 293 (2 cl.) 405 (1-cl.)[1] |

295 (3 cl.) 335 (2 cl.) 440 (1 cl.) |

- | Seating capacity | 181-255 | 218-351 | - | 245-375 | 301-440 |

| 58,8 m (192 ft 11 in) |

63,6 m (208 ft 8 in) |

58.8 m (192 ft 11 in) | Length | 48.5m | 54.9m | 61.4m | 63.7m | |

| 17.40 m | 16.9 m (55 ft 5 in) | Height | 15.8m | 15.9m | 16.8m | 18.8m | ||

| 60.3 m (197 ft 10 in) | Wingspan | 47.6m | 51.9m | 64.8m | ||||

| 5.28 m (17 ft 4 in) | Cabin Width | |||||||

| 5.64 m (18 ft 6 in) | Hull Width | 5.03 m [2] | ||||||

| 233,000 kg (513,700 lb) | Maximum take-off weight | 179,170 kg (395,000 lb) | 186,880 kg (412,000 lb) | 204,110 kg (450,000 lb) | 347,450 kg (766,000 lb) | |||

| 182,000 kg (401,200 lb) | 187,000 kg (412,300 lb) | Maximum landing weight | ||||||

| 2,200 m | 2,500 m | Takeoff run | ||||||

| 0.82 Mach (896 km/h) | Cruising speed | 0.80 Mach | 0.84 Mach | |||||

| 0.85 Mach (913 km/h or 490 knots at 35,000 ft.) | Max Speed | 0.86 Mach | 0.89 Mach | |||||

| 12,500 km | 10,500 km | 7,400 km (4,000 nm) | Range fully loaded | 12,250 km (6,600 nm) | 11,300 km (6,100 nm) | 6,100 km (3,270 nm) | 10,500 km (5,645 nm) | 17,450 km (9,420 nm) |

| 139,100 L (36,750 US gal) |

97,170 L (25,670 US gal) |

139,100 L | Max. fuel capacity | 90,770 L (23,980 US gal) |

181,280 L (47,890 US gal) |

|||

| 136 m³ 26 LD3s |

162 m³ 32 LD3s |

475 m³ | Cargo (volume) / ULDs | 81.4 m³ | 106.8 m³ | 454 m³ | 129 m³ | 150 m³ 6 LD3s |

| PW PW4000 GE CF6-80E1 RR Trent 700 |

Engines (x2) |

PW PW4062 GE CF6-80C2B7F |

PW PW4062 GE CF6-80C2B8F |

PW PW4062 GE CF6-80C2B7F RR RB211-524H |

PW PW4062 GE CF6-80C2B7F RR RB211-524H |

GE 90-110B1 | ||

| 303-320 kN 68,000-72,000 lbf |

Max Thrust (x2) |

|||||||

| Engine Ground Clearance | 0.56 m (1 ft 10 in) | 0.81 m (2 ft 8 in) | ||||||

Airbus A350 XWB vs Boeing 787 and 777

| A350 XWB | Boeing 777 | Boeing 787 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| A350-800 [3] | A350-900 [4] | A350-1000 | A350-900R[5] | A350-900F | 777-200LR | 777-200F | 777-300ER[6] | 787-9 | 787-10 [7] | |

| Two | Cockpit crew | Two | ||||||||

| 270 | 314 | 350 | 310 | 90t cargo | Passengers (3cl) | 301 | 103t cargo | 365 | 263 | 310[8] |

| 60.7 m | 67.0 m | 74.0 m | 67.0 m | Length | 63.7 m | 73.9 m | 63.0 m | 68.9 m | ||

| 17.2 m | Height | 18.8 m | 18.6 m | 18.7 m | 16.5 m | 17.0 m | ||||

| 64.8 m | Wingspan | 64.8 m | 60.0 m | 60.1 m | ||||||

| 19 ft 6 in (5.96 m)[9] | Fuselage Width | 20 ft 4 in (6.19 m) | 18 ft 11 in (5.75 m) | |||||||

| 18 ft 4 in (5.59 m) | Cabin Width | 19 ft 3 in (5.86 m) | 18 ft (5.49 m) | |||||||

| 31.9° | Wing sweep | 31.64° | 32.2° | |||||||

| 28 | 36 | 44 | LD3 containers | 32[10] | 37 pallets | 44[11] | 36 | 44 | ||

| 248 | 268 | 298 | MTOW (t) | 347.452 | 347.450 | 351.534 | 244.940 | 272.150 | ||

| 185 | 205 | 228.5 | Max landing (t) | 183.7 | 197.3 | |||||

| 115.7[EW 1] | Empty weight (t) | 145.2[EW 2] | 167.8[EW 2] | 115.3[EW 3] | 125[EW 3] | |||||

| 129,000 | 138,000 | 156,000 | Max fuel (l) | 202,287 | 181,280 | 181,280 | 138,700 | 145,000 | ||

| 0.85 | Cruise speed (M) | 0.84 | 0.85 | |||||||

| 0.89 | Max speed (M) | 0.89 | ||||||||

| 75,000 | 84,000 | 93,000 | Thrust (lb) (× 2) | 115,300 | 68,000 | 88,200 | ||||

| RR Trent XWB | Engines | GE90-110B | GE90-115B | RR Trent 1000 or GE GEnx | ||||||

| 8,300 nm 15,400 km | 8,100 nm 15,000 km | 8,000 nm 14,800 km | 9,500 nm 17,600 km | 5,000 nm 9,250 km | Range | 9,420 nm 17,445 km | 4,990 nm 9,065 km | 7,900 nm 14,630 km | 8,500 nm 15,750 km | 7,500 nm[8] 13,890 km |

| $208M | $244M | $270M | TBA | TBA | Price | $237M | $232.5M | $219M | $178.5M | TBA |

Empty weight EW:

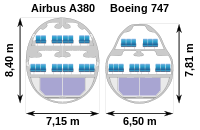

Airbus A380 vs Boeing 747

| Airbus A380 | Boeing 747 | |||

|---|---|---|---|---|

| A380-800 [12] | 747-400 [13] | 747-400ER [14] | 747-8I [15][16] | |

| Two | Cockpit crew | Two | ||

| 525 / 644 / 853 (3/2/1-class) | Passengers | 416 / 524 (3/2-class) | 467 (3-class) | |

| 73 m | Length | 70.6 m (231 ft 10 in) | 76.4 m (250 ft 8 in) | |

| 24.1 m | Height | 19.4 m (63 ft 8 in) | 19.5 m (64 ft 2 in) | |

| 79.8 m | Wingspan | 64.4 m (211 ft 5 in) | 68.5 m (224 ft 7 in) | |

| Main deck: 6.58 m (21 ft 7 in) Upper Deck: 5.92 m (19 ft 5 in) |

Cabin width | 6.1 m (20.1 ft) | ||

| 633 m² (333 + 300) | Useful cabin-area | |||

| 38 | LD3 containers | 30 | 28 | 36 |

| 276,800 kg (608,400 lb) | Empty weight | 178,756 kg (393,263 lb) | 184,570 kg (406,900 lb) | 214,500 kg (473,000 lb) |

| 361,000 kg (796,000 lb) | Max zero-fuel weight | 246,074 kg | 251,744 kg | 291,000 kg (640,000 lb) |

| 560,000 kg (1,235,000 lb) | MTOW | 396,890 kg (875,000 lb) | 412,775 kg (910,000 lb) | 442,000 kg (970,000 lb) |

| 310,000 L (81,890 US gal) | Max fuel | 216,840 L (57,285 US gal) | 241,140 L (63,705 US gal) | 241,619 L (64,221 US gal) |

| Mach 0.85 (900 km/h) | Cruise speed | Mach 0.85 (567 mph, 912 km/h at altitude) | Mach 0.855, (567 mph, 913 km/h at altitude) | |

| Mach 0.96 (1030 km/h)[17] | Max Operating Mach | Mach 0.92 (987 km/h) | ||

| 311 kN (70,000 lbf) | Thrust (× 4) | 63,300 lbf PW 62,100 lbf GE 59,500 lbf RR |

63,300 lbf PW 62,100 lbf GE |

66,500 lbf |

| GP7270, Trent 970 | Engines | PW 4062 GE CF6-80C2B5F RR RB211-524H |

PW 4062 GE CF6-80C2B5F |

GEnx-2B67 |

| 2,750 m (9,020 ft) | Takeoff run at MTOW | 3,018 m (9,902 ft) | N/A | |

| 15,200 km (8,200 nmi) | Range (3 class) | 13,450 km (7,260 nm) | 14,205 km (7,670 nm) | 14,815 km (8,000 nm) |

The widebody 747-8, as the latest modification of Boeing's largest airliner, is notably in direct competition on long-haul routes with the A380, a full-length double-deck aircraft now in service. For airlines seeking very large passenger airliners, the two have been pitched as competitors on various occasions. Following another delay to the A380 programme in October 2006, FedEx and UPS canceled their orders for the A380-800 freighter. Some A380 launch customers deferred delivery or considered switching to the 747-8 and 777F aircraft.[18][19]

Boeing is advertising claims 747-8I to be more than 10% lighter per seat and consume 11% less fuel per passenger with a trip-cost reduction of 21% and a seat-mile cost reduction of more than 6% versus the A380, for the 747-8F's empty weight is expected to be 80 tonnes (88 tons) lighter and 24% lower fuel burn per ton with 21% lower trip costs and 23% lower ton-mile costs than the A380F.[20] In order to counter a perceived strength of the 747-8I, from 2012 Airbus will offer, as an option, of improved maximum take-off weight, thus providing a better payload/range performance. The precise size of the increase in maximum take-off weight is still unknown. British Airways and Emirates will be the first customers to receive this new option.[21] As of April 2009 no airline has canceled an order for the passenger version of the A380. Boeing currently has only two commercial airline orders for the 747-8I: Lufthansa (20) and Korean Air Lines (5).[22]

A330 MRTT - KC-45A

In March 2008 the announcement that Boeing had lost a $40bn contract to Airbus to build parts for the new in-flight refuelling aircraft KC-45A for the USAF drew angry protests in the US Congress.[23] Upon review of Boeing's protest, the Government Accountability Office ruled in favor of Boeing and ordered the USAF to recompete the contract. Later, the entire competition was first rescheduled, then canceled, with a new competition expected to be decided by March 2010.[24]

EADS A330 MRTT - Northrop Grumman KC 45 A versus Boeing KC-767

Data are preliminary and partially copied from A330-200 and 767-200ER.

| A330 MRTT - KC-45 | KC-767 Advanced Tanker |

|

|---|---|---|

| Length | 59.69 m | 48.5 m |

| Height | 16.9 m | 15.8 m |

| Fuselage Width | 5.64 m | 5.03 m |

| Wingspan | 60.3 m | 47.57 m |

| Surface area | 361.6 m² | |

| Engines | 2x RR Trent 700 or GE CF6-80 turbofans |

2x Pratt & Whitney PW4062 |

| Thrust (× 2) | 316 kN | 282 kN |

| Passengers | 226 - 280[25] | 190 |

| Range | 12,500 km | 12,200 km |

| Cruise speed | 860 km/h | Mach 0.80 (851 km/h) |

| Max speed | Mach 0.86 (915 km/h) | Mach 0.86 (915 km/h) |

| Max takeoff weight | 230 t | 181 t |

| Max landing weight | 180 t | 136 t |

| Normal fuel load | 250,000 lb (113,500 kg) | 161,000 lb (73,100 kg) |

| Maximum fuel load | 250,000 lb (113,500 kg) plus 95,800 lb (43,500 kg) of additional cargo or fuel load |

over 202,000 lb (91,600 kg) |

| Cargo (standard pallets) | 32 (463L) pallets | 19 (463L) pallets |

Competition by outsourcing

Because many of the world’s airlines are wholly or partly government owned, aircraft procurement decisions are often taken according to political as well as commercial criteria. Boeing and Airbus seek to exploit this by subcontracting production of aircraft components or assemblies to manufacturers in countries strategically important in order to gain competitive advantage.

For example, Boeing has offered longstanding relationships with Japanese suppliers including Mitsubishi Heavy Industries and Kawasaki Heavy Industries by which these companies have had increasing involvement on successive Boeing jet programs, a process which has helped Boeing achieve almost total dominance of the Japanese market for commercial jets. Outsourcing was extended on the 787 to the extent that Boeing’s own involvement was reduced to little more than project management, design, assembly and test operation, outsourcing most of the actual manufacturing all around the world. Boeing has since stated that it "outsourced too much" and that future airplane projects will depend far more on Boeing's own engineering and production personnel.[26]

Partly because of its origins as a consortium of European companies, Airbus has had fewer opportunities to outsource significant parts of its production beyond its own European plants. However, in 2009 Airbus has opened an assembly plant in Tianjin, China for production of its A320 series airliners.[27]

Competition through use of technology

One of the ways Airbus sought to compete with the well-established Boeing in the 1970s was through the introduction of advanced technology. For example, the A300 made the most extensive use of composite materials yet seen in an aircraft of that era, and by automating the flight engineer's functions, was the first large commercial jet to have a two-man flight crew. In the 1980s Airbus was the first to introduce digital fly-by-wire controls into an airliner (the A320).

Now that Airbus has established itself as a viable competitor to Boeing, both companies use advanced technology to seek performance advantages in their products. For example, the Boeing 787 will be the first large airliner to use composites for most of its construction.

Competition through provision of engine choices

The competitive strength in the market of any airliner is considerably influenced by the choice(s) of engine available. In general, airlines prefer to have a choice of at least two engines from the major manufacturers General Electric, Rolls-Royce and Pratt & Whitney. However the engine manufacturers clearly prefer to be single source, and sometimes succeed in striking commercial deals with Boeing and Airbus to achieve their objective. Hence several notable aircraft have only provided a single engine offering: the Boeing 737-300 series onwards (CFM56), the Airbus A340-500 & 600 (Rolls-Royce Trent 500), the Airbus A350 (Rolls-Royce Trent XWB - so far) and the Boeing 747-8 (GEnx-2B67).[28]

Effect of currency on competition

Boeing's production costs are mostly in US dollars, while Airbus' production costs are mostly in euro. When the dollar appreciates against the euro the cost of producing a Boeing aircraft rises relative to the cost of producing an Airbus aircraft, and conversely when the dollar falls relative to the euro it is an advantage for Boeing. There are also possible currency risks and benefits involved in the way the aircraft are sold. Boeing typically prices its aircraft only in dollars, while Airbus, although pricing most aircraft sales in dollars, has been known to be more flexible and has priced some aircraft sales in Asia and the Middle East in multiple currencies. Depending on currency fluctuations between the acceptance of the order and the delivery of the aircraft this can result in an extra profit or extra expense - assuming Airbus has not purchased insurance against such fluctuations.[29]

Orders and deliveries

| 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | |

| 388 | 271 | 777 | 1341 | 790 | 1055 | 370 | 284 | 300 | 375 | 520 | 476 | 556 | 460 | 326 | 106 | 125 | 38 | 136 | 101 | 404 | 421 | |

| 489 | 142 | 662 | 1413 | 1044 | 1002 | 272 | 239 | 251 | 314 | 588 | 355 | 606 | 543 | 708 | 441 | 125 | 236 | 266 | 273 | 533 | 716 | |

| Sources 2010: Airbus net orders until November 30 (http://www.airbus.com/en/corporate/orders_and_deliveries/) Boeing net orders until November 30 (http://active.boeing.com/commercial/orders/index.cfm) |

||||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | |

| 461 | 498 | 483 | 453 | 434 | 378 | 320 | 305 | 303 | 325 | 311 | 294 | 229 | 182 | 126 | 124 | 123 | 138 | 157 | 163 | 95 | 105 | |

| 420 | 481 | 375 | 441 | 398 | 290 | 285 | 281 | 381 | 527 | 491 | 620 | 563 | 375 | 271 | 256 | 312 | 409 | 572 | 606 | 527 | 402 | |

| Sources 2010: Airbus deliveries until November 30 (http://www.airbus.com/en/corporate/orders_and_deliveries/) Boeing deliveries until November 30 (http://active.boeing.com/commercial/orders/index.cfm?content=displaystandardreport.cfm&optReportType=CurYrDelv) |

||||||||||||||||||||||

Yearly orders. |

Yearly deliveries. |

Orders/Deliveries overlay. |

Boeing's product plan

Since the 1970s Boeing has faced increasing competition from Airbus, which has expanded its family of aircraft to the point where Airbus and Boeing now cover an almost identical market. Airbus has delivered more planes than Boeing every year from 2003 onwards. Airbus orders have exceeded Boeing's in every year since 1999 except for 2000, 2006 and 2007, which went to Boeing. In 2005 Airbus won more orders by number, but Boeing won 55% by value. In summary, of the last 10 years (2000–2009), Airbus won 6,452 orders while delivering 3,810, Boeing won 5,927 orders while delivering 3,950.

The A320 has been selected by 222 operators (Dec. 2008), among these several low-cost operators, gaining ground against the previously well established 737 in this sector; many full-service airlines also have selected it as a replacement for 727s and aging 737s, such as United Airlines and Lufthansa; and after 40 years the A380 now challenges the Boeing 747s dominance of the very large aircraft market. The 747-8 is a stretched and updated version of the venerable 747-400 and will offer greater capacity, fuel efficiency and longer range. Frequent delays to the Airbus A380 program caused several customers to consider cancelling their orders in favour of the refreshed 747-8,[30] although none have done so and some have even placed repeat orders for the A380. However, all A380F orders have been canceled. To date, Boeing has secured orders for 78 747-8F and 28 747-8I with first deliveries scheduled for 2010 and 2011 respectively, while Airbus has orders for 234 A380s, the first of which entered service in 2007.

Several Boeing projects were pursued and then canceled, like the Sonic Cruiser, launched in 2001. Boeing is now focused on the 787 Dreamliner as a platform of total fleet rejuvenation, which uses technology from the Sonic Cruiser concept. Despite having been delayed by more than two years, the 787 is the fastest selling wide-body airliner in history. The 787's rapid sales success and pressure from potential customers forced Airbus to revise the design of its competing A350.

In 2004, Boeing ended production of the 757 after 1055 were produced. More advanced, stretched versions of the 737 were beginning to compete against the 757, and the proposed 787-3 will fill some of the top end of the 757 market. Also that year, Boeing announced that the 717, the last civil aircraft to be designed by McDonnell Douglas, would cease production in 2006. The 767 was in danger of cancellation as well, with the 787 replacing it, but recent orders for the freighter version have extended the program and the uncertainty of the deliveries of the 787 also prolongs the deliverance. The passenger version of the Boeing 747-400 ceased production on March 17, 2008. However, the freighter version will remain in production until the first delivery of the 747-8F.

Recently, Boeing launched five new variants of existing designs: the ultra-long-range 777-200LR, 737-900ER, 737-700ER, 777 Freighter and the 747-8. The 777-200LR has the longest range of any commercial aircraft and was designed to compete with the Airbus A340-500. It was first delivered in 2006. The 737-900ER and 737-700ER are the extended range variants of the -900 and -700 models. Due to rising fuel costs, the more efficient twinjet 777 has been winning orders at the expense of the four-engined Airbus A340.

There are 5,417 (April 30, 2009) Airbus aircraft in service, with Airbus managing to win over 50 per cent of aircraft orders in recent years. Airbus products are outnumbered by in-service Boeings (there are about 4,495 Boeing 737s alone in service,[31] about 13,000 total[32]).

Safety

Both aircraft manufacturers have good safety records on recently-manufactured aircraft. By convention, both companies tend to avoid safety comparisons when selling their aircraft to airlines. Most aircraft dominating the companies' aircraft sales, such as the Boeing 737-NG and Airbus A320 families (as well as both companies' wide-body offerings) have good safety records as well. Older model aircraft such as the Boeing 727, Boeing 737 Original, Boeing 747, Airbus A300 and Airbus A310, which were respectively first flown during the 1960s, 1970s, and 1980s, have had higher rates of fatal accidents.[33]

Controversies

Subsidies

Boeing has continually protested over launch aid in form of credits to Airbus, while Airbus has argued that Boeing receives illegal subsidies through military and research contracts and tax breaks.

In July 2004 Harry Stonecipher (then-Boeing CEO) accused Airbus of abusing a 1992 bilateral EU-US agreement providing for disciplines for large civil aircraft support from governments. Airbus is given reimbursable launch investment (RLI, called "launch aid" by the US) from European governments with the money being paid back with interest, plus indefinite royalties if the aircraft is a commercial success.[34] Airbus contends that this system is fully compliant with the 1992 agreement and WTO rules. The agreement allows up to 33 per cent of the programme cost to be met through government loans which are to be fully repaid within 17 years with interest and royalties. These loans are held at a minimum interest rate equal to the cost of government borrowing plus 0.25%, which would be below market rates available to Airbus without government support[35]. Airbus claims that since the signing of the EU-U.S. agreement in 1992, it has repaid European governments more than U.S.$6.7 billion and that this is 40% more than it has received.

Airbus argues that the pork barrel military contracts awarded to Boeing (the second largest U.S. defense contractor) are in effect a form of subsidy (see the Boeing KC-767/EADS KC-45 military contracting controversy). The significant U.S. government support of technology development via NASA also provides significant support to Boeing, as does the large tax breaks offered to Boeing which some claim are in violation of the 1992 agreement and WTO rules. In its recent products such as the 787, Boeing has also been offered substantial support from local and state governments[36]. However, Airbus' parent, EADS, itself is a military contractor, and is paid to develop and build projects such as the A400M transport and various other military aircraft.[37]

In January 2005, the European Union and United States trade representatives, Peter Mandelson and Robert Zoellick (since replaced by Rob Portman, and then Susan Schwab, and the present office holder, Ron Kirk) respectively, agreed to talks aimed at resolving the increasing tensions. These talks were not successful with the dispute becoming more acrimonious rather than approaching a settlement.

In September 2009, the New York Times and Wall Street Journal reported that the World Trade Organization would likely rule against Airbus on most, but not all, of Boeing's complaints; the practical effect of this ruling would likely be blunted by the large number of international partners engaged by both plane makers. as well as the expected delay of several years of appeals. For example, 35% of the Boeing 787 is manufactured in Japan. Thus, some experts are advocating a negotiated settlement.[38] In addition, the heavy government subsidies offered automobile manufacturers in the United States have changed the political environment; the subsidies offered Chrysler and General Motors dwarf the amounts involved in the Airbus-Boeing dispute.[39]

World Trade Organization litigation

"We remain united in our determination that this dispute shall not affect our cooperation on wider bilateral and multilateral trade issues. We have worked together well so far, and intend to continue to do so."

On 31 May 2005 the United States filed a case against the European Union for providing allegedly illegal subsidies to Airbus. Twenty-four hours later the European Union filed a complaint against the United States protesting support for Boeing.[41]

Tensions increased by the support for the Airbus A380 have erupted into a potential trade war due to the upcoming launch of the Airbus A350. Airbus would ideally like the A350 programme to be launched with the help of state loans covering a third of the development costs although it has stated it will launch without these loans if required. The A350 will compete with Boeing's most successful project in recent years, the 787 Dreamliner. EU trade officials questioned the nature of the funding provided by NASA, the Department of Defense, and in particular the form of R&D contracts that benefit Boeing; as well as funding from US states such as the State of Washington, Kansas, and Illinois, for the development and launch of Boeing aircraft, in particular the 787.[42] An interim report of the WTO investigation into the claims made by both sides was made in September 2009.[43]

In March 2010, the WTO ruled that European governments unfairly financed Airbus.[44] The WTO delayed its ruling on the European Union's complaint against US state aid for Boeing.[45]

In September 2010, a preliminary report of the WTO found unfair Boeing payments broke WTO rules and should be withdrawn.[46]

See also

- Boeing

- Boeing Commercial Airplanes

- EADS

- Airbus

- Airbus Executive and Private Aviation

- Comparison of commercial aircraft

References

- ↑ Airbus.com: TECHNICAL BACKGROUNDER A330-200

- ↑ Boeing dévoile les formes définitives de son 787 Dreamliner

- ↑ Airbus's A350 vision takes shape Flight international

- ↑ Airbus product comparisons

- ↑ Airbus goes for extra width - A350 XWB special report. Flight international

- ↑ Boeing 777 Technical Specification. www.boeing.com

- ↑ Boeing 787-10ER Technical Specification

- ↑ 8.0 8.1 Boeing admits 787-10 could face pressure. Flight international

- ↑ A350 Specifications

- ↑ Factsheet Boeing 777-200

- ↑ Factsheet Boeing 777-300

- ↑ Airbus: A380 specifications

- ↑ Boeing: 747-400 specifications

- ↑ Boeing: 747-400ER specifications

- ↑ Boeing: 747-8 specifications

- ↑ Boeing: 747-8 Airport Compatibility Brochure

- ↑ Kingsley-Jones, Max (20 December 2005). "A380 powers on through flight-test". Flight International. http://www.flightglobal.com/articles/2005/12/20/203708/a380-powers-on-through-flight-test.html. Retrieved 2007-09-25.

- ↑ Robertson, David. "Airbus will lose €4.8bn because of A380 delays", Time, 3 October 2006.

- ↑ Schwartz, Nelson D. "Big plane, big problems", CNN, 1 March 2007.

- ↑ http://www.boeing.com/commercial/747family/747-8_background.html Boeing 747-8 Family background

- ↑ British Airways and Emirates will be first for new longer-range A380

- ↑ [1]

- ↑ Air tanker deal provokes US row, BBC, 1 March 2008

- ↑ "The USAF’s KC-X Aerial Tanker RFP: Canceled". Defense Industry Daily. 2008-09-110. http://www.defenseindustrydaily.com/the-usafs-kcx-aerial-tanker-rfp-03009/.

- ↑ Northrop Grumman Integrated Systems - KC-45 Tanker

- ↑ Gates, Dominic (March 1, 2010). "Albaugh: Boeing's 'first preference' is to build planes in Puget Sound region". The Seattle Times. http://seattletimes.nwsource.com/html/businesstechnology/2011228282_albaugh02.html. Retrieved 2010-06-16.

- ↑ "Airbus' China gamble". Flight International. October 28, 2008. http://www.flightglobal.com/articles/2008/10/28/317890/airbus-china-gamble.html. Retrieved 2008-11-15.

- ↑ Thomas, Geoffrey (April 4, 2008). "Engines the thrust of the Boeing-Airbus battle". The Australian. http://www.theaustralian.news.com.au/story/0,25197,23479281-23349,00.html. Retrieved 2008-11-08.

- ↑ Strong Euro Weighs on Airbus, Suppliers, Wall Street Journal, October 30, 2009, p.B3

- ↑ Robertson, David (October 4, 2006). "Airbus will lose €4.8bn because of A380 delays". London: The Times Business News. http://business.timesonline.co.uk/article/0,,9077-2387999,00.html.

- ↑ Boeing: 737 Facts

- ↑ Politics: Boeing: 100 years

- ↑ Statistical Summary of Commericial Jet Airplane Accidents: Worldwide Operations 1959-2007

- ↑ Oconnell, Dominic; Porter, Andrew (2005-05-29). "Trade war threatened over £379m subsidy for Airbus". The Times (London). http://www.timesonline.co.uk/article/0,,2095-1631948,00.html. Retrieved Insert accessdate here.

- ↑ "Q&A: Boeing and Airbus". BBC News. 2004-10-07. http://news.bbc.co.uk/2/hi/business/3722888.stm. Retrieved Insert accessdate here.

- ↑ "See you in court". The Economist. 23 March 2005. http://www.economist.com/business/displayStory.cfm?story_id=3793314.

- ↑ EADS Military Air Systems Website, retrieved September 3, 2009

- ↑ W.T.O. to Weigh In on E.U. Subsidies for Airbus, New York Times, September 3, 2009, retrieved September 3, 2009

- ↑ Boeing Set for Victory Over Airbus in Illegal Subsidy Case, Wall Street Journal, September 3, 2009, p.A1

- ↑ "EU, US face off at WTO in aircraft spat". Defense Aerospace. 31 May 2005. http://www.defense-aerospace.com/article-view/feature/57874/analysis:-us-reopens-aircraft-subsidy-dispute.html.

- ↑ "Flare-up in EU-US air trade row". BBC News. 31 May 2005. http://news.bbc.co.uk/2/hi/business/4594581.stm. Retrieved 2010-01-02.

- ↑ Milmo, Dan (14 August 2009). "US accuse Britain of stoking trade row with £340m Airbus loan". London: The Guardian. http://www.guardian.co.uk/business/2009/aug/14/us-uk-trade-row-airbus.

- ↑ "US refuses to disclose WTO ruling on Boeing-Airbus row". EU Business. 5 September 2009. http://www.eubusiness.com/news-eu/wto-trade-dispute-us.bq/.

- ↑ "WTO says Europe subsidizes Airbus, Boeing's rival, unfairly". USA Today. 3 March 2010. http://www.usatoday.com/money/industries/manufacturing/2010-03-24-boeingairbus24_ST_N.htm. Retrieved 2010-06-16.

- ↑ Wilson, Amy (9 July 2010). "Boeing WTO ruling delayed as EADS bids for tanker contract". London: The Telegraph. http://www.telegraph.co.uk/finance/newsbysector/industry/7880344/Boeing-WTO-ruling-delayed-as-EADS-bids-for-tanker-contract.html.

- ↑ "EU claims victory in WTO case versus Boeing". Paris: Reuters. 15 September 2010. http://www.reuters.com/article/idUSTRE68E47T20100915.

Further reading

Newhouse, John (2007), Boeng versus Airbus, USA: Vintage Books, ISBN 978-1-4000-7872-1

External links

- Official Airbus Website

- Official Airbus Military website

- Complete production lists of all Airbus models

- Official Boeing Website

- Seatguru: Airplane seating chart for many Airlines and Boeings, Airbusses and others

- BBC Q&A: Boeing and Airbus

|

||||||||||||||

|

|||||||||||||||||